By: DSIRE Insight Team

In a nearly annual tradition, Congress made a number of important changes to the tax code in the waning days of 2020. The Taxpayer Certainty and Disaster Relief Act of 2020 extended the expiration date of a number of tax incentives, giving system owners and developers additional time to place their systems in service or begin construction.

Investment Tax Credit

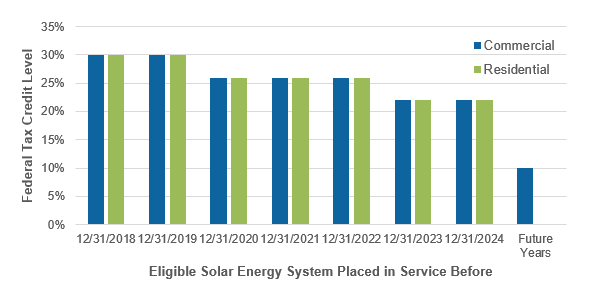

Legislation enacted in previous years established a step-down in the credit amounts for the Business Energy Investment Tax Credit (ITC). The deadlines for solar systems were extended by two years. Projects placed in service before December 31, 2022 will qualify for a tax credit based on 26% of the installed cost. Projects placed in service before December 31, 2024 will qualify for a 22% tax credit, before permanently dropping to 10%. Projects started before the end of 2024 and placed in service before the end of 2026 will also be eligible for a 22% tax credit.

The amendments to the ITC also made offshore wind projects eligible for the credit. Offshore wind projects started before the end of 2025 can qualify for a full 30% tax credit. The Residential Renewable Energy Tax Credit has a similar step-down schedule, except the credit phases out entirely for system installed in 2024 or later.

Federal Investment Tax Credit Step-Down Schedule for Solar Energy Systems

Production Tax Credit

The Renewable Electricity Production Tax Credit (PTC) was also modified in recent years to include a step-down for wind systems, and an expiration date for all systems requiring construction to start by the end of 2020. The new deadline established by the 2020 stimulus bill is the end of 2021. Wind projects started in 2020 or 2021 can qualify for a production tax credit based on 60% of the full rate. Interestingly, the step-down was not applied to the other PTC-eligible technologies, including biomass, landfill gas, waste heat to energy, and certain hydroelectric systems. Instead, the PTC for these systems was initially allowed to expire. When they were later reinstated, the step-down was not applied to them. Thus, the extended expiration date for these technologies allows such projects started by the end of 2021 to claim the full PTC.

Energy Efficiency Tax Credits

The expiration date for the Residential Energy Efficiency Tax Credit and the Energy-Efficient New Homes Tax Credit for Home Builders were both extended by a year, making eligible projects completed by the end of 2021 eligible. And the Energy-Efficient Commercial Buildings Tax Deduction was made permanent with the exact value of the deduction being adjusted annually for inflation.

* * *

Visit the Database of State Incentives for Renewables and Efficiency (DSIRE) for more information on federal and state incentives for renewable energy energy efficiency technologies. View DSIRE Insight offerings to stay on top of state policy changes.