By: Brian Lips, Sr. Policy Project Manager

A record 434,879 electric vehicles (EVs) were sold in the U.S. in 2021. Facing growing demand, manufacturers continue announcing new models to further electrify the transportation sector. This surging market will surely help states meet their climate goals, and open new business opportunities for electric utilities. But could a new source of electricity demand be more of a detriment to utilities, which, in some states, already have challenges meeting their peak demands? The California Energy Commission, for example, projects EV charging will add an additional demand of nearly 1,000 MW before 8:00 PM on top of the already challenging duck curve.

With no other market interventions, EV owners who commute to work could be inclined to charge their vehicles when they return in the late afternoon and exacerbate these growing demand curves. However, with proper incentives or more direct utility involvement to shift the EV demand curve, EV charging could provide a myriad of benefits to consumers and the electric system as a whole. While the EV industry and its effects on the grid are still very new and vary from state to state, utilities have started exploring different approaches to influence customer charging behavior, commonly referred to as managed charging.

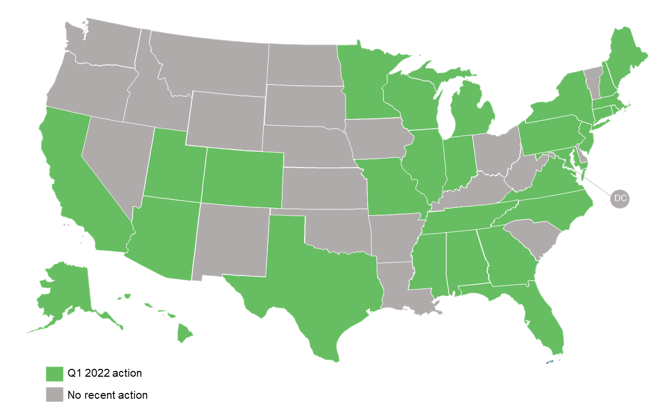

Q1 2022 State and Utility Action on EV Rate Design & Managed Charging

The Smart Electric Power Alliance draws a distinction between active and passive managed charging, which are analogous to the existing utility approaches to managing demand generally. Passive managed charging uses price signals like time-varying rates or peak time rebates to encourage customer behavior, while active managed charging gives utilities direct control over the load similar to a demand response program.

The 50 States of Electric Vehicles quarterly report series tracks ongoing efforts by state policymakers and utilities to expand the market for EVs, including proposals from utilities for managed charging programs. To date, the majority of utility proposals identified in the 50 States of Electric Vehicles reports have been passive managed charging. But several utilities have taken action in recent months to roll out active managed charging programs.

Duke Energy filed an application with the North Carolina Utilities Commission in February 2022 for a new managed charging pilot program. The pilot program combines a fixed monthly subscription rate for residential EV charging with a managed charging element. Customers will be able to charge their vehicle whenever and however often they like, but will receive a warning from Duke if they consume more than 800 kWh in a month. Meanwhile, Duke will have the right to pause a customer’s charging for up to four hours three times per month. Duke believes customers will be attracted to the predictability of a set monthly fee, while the managed charging aspects of the program will limit its negative impacts on the system.

In Wisconsin, Madison Gas and Electric filed its own application in March 2022 for three new managed charging pilot programs. The programs separately target apartments and workplaces, fleets, and single-family residential customers. Through the pilot programs for apartments and workplaces and fleets, the utility will own and install charging equipment at customer sites in exchange for a monthly fee, which ensures there is no cross-subsidization from non-participating customers. Participants will then receive an annual credit of $40 in exchange for the utility having remote access to control their charging. The single-family residential program builds off of the utility’s existing Charge@Home program, but targets customers who charge at home with a 240-volt cord instead of installing a charging station. Without a charging station, Madison Gas & Electric cannot manage the customer’s charging through the Charge@Home program, but the new program gives that control to the utility through telematics.

The managed charging programs in existence today and those being actively considered by utilities and regulators use different incentive structures and design features to achieve the same result. Utilities and stakeholders alike want to shift customer charging behavior to limit the potential negative impacts of increased demand, and instead utilize excess capacity during off-peak times to benefit the system as a whole. With so much at stake and with an ever expanding interest in electric vehicles, we expect to see more and more managed charging proposals from utilities in the months and years to come.

* * *

To stay on top of managed charging programs and other EV-related policy activity, check out the 50 States of Electric Vehicles report series or the DSIRE Insight Electric Vehicle Single-Tech Subscription.