By: Brian Lips, Senior Project Manager

Our Q2 2023 50 States of Power Decarbonization Report found that 31 states took action during the quarter related to Clean Energy Standards (CES) or Renewable Portfolio Standards (RPS), including the consideration of at least 50 bills. RPS policies require utilities in a given state to have a certain percentage of their electricity sales come specifically from renewable energy sources by a certain date, while CES policies often build upon and are inclusive of RPS policies. CES policies generally require utilities to transition to carbon-free resources, including nuclear larger hydro systems, and other carbon-neutral technologies. Long used as the centerpiece of many states’ renewable energy policy framework, recent years have seen a slightly diminished focus on pure RPS policies. States are increasingly considering further refinement of their electricity markets through a more holistic lens that includes CES and net-zero carbon policies. In other cases, renewable energy development has far outpaced the requirements established by a state’s RPS policy, leading some to wonder, do RPS policies still matter?

The Birth of a Policy Mechanism

The first Renewable Portfolio Standards (RPS) were adopted by states in the 1990s, often as part of wider deregulation legislation. States that were restructuring their electricity markets to incorporate competition wanted to ensure that emerging renewable energy technologies were not shut out from the marketplace due to their higher cost. Policymakers viewed RPS policies as an effective approach to reserve a portion of the electricity sector for renewables, allowing them to compete on price with other renewables only, rather than coal and other established resources. By 1997, six states had an RPS. The requirements were quite modest with the exception of Maine; though Maine had already met its requirement when the law was enacted because it allowed hydropower as an eligible resource.

Renewable Portfolio Standards, 1997

Nine years later, 18 states had adopted an RPS, and three additional states had non-binding goals. The individual requirements increased too, with many states requiring 10% - 20% of their retail electric sales to come from renewable energy sources. States also started adopting carve-outs or credit multipliers within their policies for solar or other distributed generation. For many states, their RPS stood as the cornerstone of their renewable energy policy structure, layering other incentives on top of their requirements, and fostering robust markets for renewable energy credits.

Renewable Portfolio Standards, 2006

To the Present Day

Several additional states adopted an RPS between 2006 and 2009, and Vermont changed its voluntary goal into a mandatory requirement in 2015. In the intervening years, states continued tinkering with their RPS policies, mostly adjusting the eligible technologies, extending their timelines, and increasing the required percentages of renewable energy. Policymakers in some states also turned to the familiar RPS structure to jumpstart a market for newer technologies. Either within the context of their existing RPS or as a separate stand-alone policy, states are adopting procurement requirements for energy storage and offshore wind. As in the case of some of the earlier RPS policies, these requirements are often expressed as a specific megawatt or gigawatt of installed capacity, rather than a percentage of retail sales.

While the 2000’s saw a rapid adoption of RPS policies across the country, and the 2010’s saw continued strengthening and refinement of these policies, the past few years have seen less development of purely renewable portfolio standards. Policymakers in many states have instead started shifting their focus to CES policies, often layering them on top of an existing RPS. By expanding their policies to include all “clean energy” resources beyond traditional renewables, policymakers are able to set higher targets. Today, 22 states plus DC and Puerto Rico have a mandatory requirement or non-binding goal requiring 100% clean energy or net-zero emissions from the electricity sector. These generally have very long time horizons, often between 2040 and 2050.

Renewable and Clean Energy Standards, August 2023

The Lone Driver?

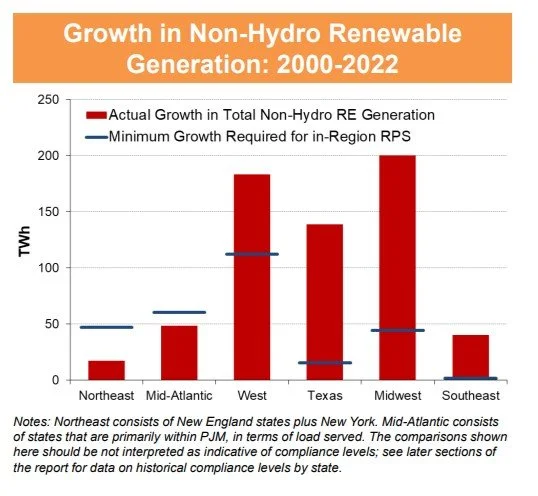

Lawrence Berkeley National Laboratory’s U.S. State Renewables Portfolio & Clean Electricity Standards: 2023 Status Update compares the actual growth of non-hydro renewable generation to the amount required by RPS and CES policies. Interestingly, the report finds that from 2000 to 2022, the total generation from renewable energy has increased by 630 TWh, while the collective RPS policies only required 281 TWh.

Source: Barbose, G. U.S. State Renewables Portfolio & Clean Electricity Standards: 2023 Status Update. (June 2023)

The report also finds that this dynamic is not uniform across the country. The numbers are heavily skewed by the amount of renewable energy installed in states that do not have an RPS or CES, or that have an RPS with a low requirement, such as the Southeast and parts of the Midwest. Texas, for its part, actually repealed its RPS in June of this year. Though its capacity-based target had already been satisfied many times over. States in the Northeast and Mid-Atlantic; meanwhile, show that their collective RPS requirements are providing a large ceiling that is continuing to drive actual development.

Source: Barbose, G. U.S. State Renewables Portfolio & Clean Electricity Standards: 2023 Status Update. (June 2023)

As is often the case with state-level energy policy, RPS design and outcomes vary substantially from state to state, and are tied to specific state policy goals. But RPS policies are just one element of a state’s policy landscape for renewable energy. Other factors, like market design, incentives, and PURPA implementation can play a significant role in the development of renewable energy resources. The private sector is also influencing the development of these resources, with many companies committing to purchase renewable energy. The Smart Electric Power Alliance’s Carbon Reduction Tracker also highlights a growing number of utility companies voluntarily adopting carbon reduction targets.

While there are other policy tools and general market dynamics to stimulate renewable energy development, RPS policies do still matter. The first compliance periods for CES policies are still years away, and it remains to be seen if states and utilities will meet their targets, which are dependent on new technologies becoming available. RPS policies, meanwhile, are a tested mechanism with a long track record of encouraging a diverse portfolio of resources. Even as states and utilities begin planning for their CES compliance, renewables will clearly continue having a role to play. RPS policies will continue having a say in how these resources are deployed, and they can be augmented overtime to achieve new policy goals.

Stay up to date on renewable portfolio standards, clean energy standards, and other power decarbonization policies with DSIRE Insight’s 50 States of Power Decarbonization report. Visit the Database of State Incentives for Renewables and Efficiency to learn about states’ existing renewable and clean energy standards.