By: Seth Laney, Energy Policy Research Assistant

Energy efficiency, simply put, means using less energy to complete the same task. As a homeowner, there are many opportunities to reduce utility bills by transitioning to more energy-efficient products. However, one major obstacle consumers face is the high upfront cost of these technologies. Fortunately, federal programs such as the Home Energy Rebate Programs can help offset these costs through grants, loans, or tax credits. Specific eligibility requirements for these incentives can be found on your state energy office’s website. Before discussing the current status of this program and its financial incentives, let's briefly examine its legislative source, the Inflation Reduction Act (IRA) of 2022.

Background

The IRA, enacted by the 117th United States Congress, aims to lower energy costs for homeowners through initiatives such as the Home Energy Rebate Programs. These programs allocate $8.8 billion in funding to state energy offices and Indian tribes for home energy upgrades. The two primary rebate programs are:

Home Electrification Rebate Program (HER or HOMES) – $4.5 billion allocated

Home Efficiency Rebate Program (HEAR) – $4.3 billion allocated

To receive funding, the U.S. Department of Energy (DOE) required state energy offices to submit program plans and applications by January 31, 2025. The map below details the distribution of funds by state.

State Allocations Under the IRA Home Energy Rebate Programs

Current Program Status

This funding data originates from the DOE’s November 2022 announcement on state and tribal allocations. To verify this information, I reviewed state energy office reports. While many states have been awarded the necessary funds, they are currently unable to distribute them due to Section 7 of President Trump’s executive order on “Unleashing American Energy.” This order has paused the disbursement of IRA-appropriated funds, delaying the implementation of the rebate programs.

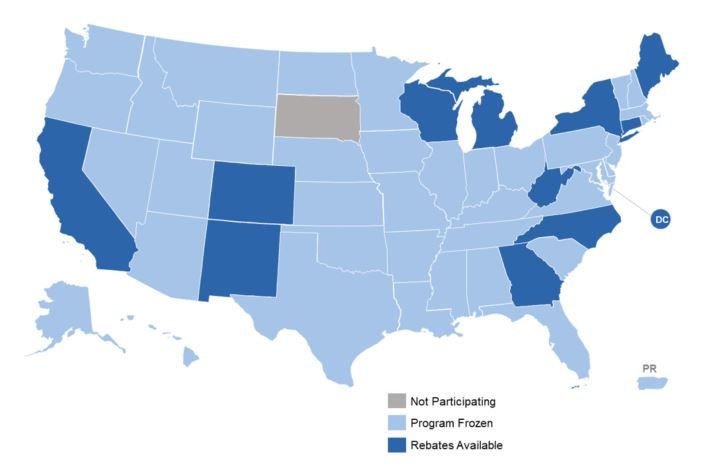

Current Status of the Home Energy Rebate Programs by State (March 2025)

This second map outlines the current status of the rebate programs by state. Of the 49 participating states (South Dakota opted out), only 11 states are actively accepting rebate applications, in addition to the District of Columbia. However, Puerto Rico is not yet accepting applications and several other states anticipate opening their programs later this year.

What’s Next?

The Environmental and Energy Law Program at Harvard Law School has created a figure that effectively illustrates the executive and congressional control mechanisms influencing IRA funding.

Source: Harvard Law School Environmental and Energy Law Program, Executive and Congressional Control Mechanisms over IRA and IIJA Funding

According to their analysis, two key factors determine the fate of these programs: the type of funding (grant, loan, tax credit) and the stage of project development. For the most up-to-date information, visit the Database of State Incentives for Renewables and Efficiency, the DOE, or your State Energy Office’s website regularly.

Citations