By: Rebekah de la Mora, Policy Analyst

Earlier this month, the NC Sustainable Energy Association held its annual Making Energy Work conference. The DSIRE Team, as part of its work at the NC Clean Energy Technology Center (Center or NCCETC), hosted a pre-conference workshop on Growing the On-Site Solar Generation Market in North Carolina. The workshop covered the challenges and opportunities associated with the on-site solar market in the state. The workshop was organized and framed by the Center, with the Center also leading discussions to gather input from interested distributed solar stakeholders. Participants came from solar installers, state and local government, non-profit and advocacy groups, financing entities, and end-use customers.

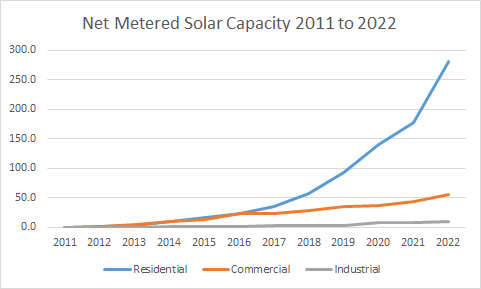

For background, North Carolina is one of the top solar states in the country, with over 8,000 MW installed as of June 2023, putting it behind California, Texas, and Florida, according to the Solar Energy Industries Association. When it comes to net-metered solar specifically, North Carolina is ranked 16th at 345 MW, based on data from the U.S. Energy Information Administration. Almost all distributed solar in the state is owned and operated by the energy consumer, with very small amounts of third party leasing and community solar. In addition, new changes to net metering tariffs will eventually require all customer-generators to take service under a time-of-use (TOU) rate, though there are bridge options available for the next few years between the legacy net metering program and newer rate designs. Many states and utilities are now offering TOU rates to residential customers, and North Carolina is one of the first movers requiring residential net metering customers to take TOU service.

Source: U.S. Energy Information Administration Form 861-M, 2021-2022 North Carolina data.

Source: U.S. Energy Information Administration Form 861-M, 2021-2022 North Carolina data.

CHALLENGES

When it comes to growing the state’s distributed solar market, participants identified various challenges that cut across end-use sectors. Misinformation is common across the industry, and the public needs more robust education to understand on-site solar. Regulatory complexity and uncertainty often confound this issue (if navigating the field and its regulations is difficult for industry professionals, how can non-professionals do it?).

The recently revised rules for net metering can introduce new complexity to the process while reducing the return on investment. Clarity on rules and applications for on-site battery storage systems will also be important, especially as net metering in the state moves towards TOU rates. There is also a need for workforce education and development, which is an existing challenge and will be exacerbated by market growth. Growing the distributed solar market is predicated on being a viable investment; high financing rates and long returns on investment can make it difficult for customers who want on-site generation to justify it.

Challenges that were identified by workshop participants, sorted by which sector-specific discussion group noted the challenge:

| Residential | Cross-Sector | Commercial & Industrial |

|---|---|---|

| Low Electricity Rates | Financing Rates | Limits on System Sizes |

| Lack of Programs for LMI Customers | Net Metering Rules and Changes to Net Metering Rules | Net Metering Under Time-of-Use Rates |

| Access Issues (HOAs, Policy Barriers) | Misinformation and a Need for Public Education | |

| Lack of Coordinated Advocacy | Regulatory and Utility Complexity and Uncertainty | |

| Awareness, Availability, and Integration of Battery Storage | ||

| Workforce Development |

For residential generation, specific challenges identified include low electricity rates, lack of specific programs for low- and moderate-income (LMI) households, access issues, and a lack of coordinated advocacy. Because of relatively low electricity rates in North Carolina, the monetary benefits from installing solar are somewhat smaller and the return on investment is longer. This challenge is exacerbated for LMI customers, who often have less access to immediate capital or loans compared to higher-income customers; on-site generation becomes prohibitively expensive for LMI customers, and a lack of LMI carve-outs or focus in solar programs means that LMI customers cannot reach the proportional level of assistance that higher-income customers are receiving.

NCCETC Policy Analyst Vincent Potter providing an introduction on North Carolina’s distributed solar market at the November 2023 workshop.

On top of that, while a customer may have the financial ability to install on-site solar, they might not have the legal or authoritative ability. Rules restricting on-site generation from Homeowner Associations (HOAs) mean many residents are unable to install solar even if they want to, not to mention residents who live in multi-family housing or who rent their house. While North Carolina has a solar access law that generally prohibits local governments from restricting on-site solar generation for homes, HOAs and other private organizations can still restrict it in certain ways. Finally, advocacy across the state is not coordinated across actors, limiting their ability to drive effective change on these issues.

For commercial and industrial (C&I) generation, specific challenges identified include net energy metering compensation changes and limits on system sizes. New TOU requirements may significantly reduce compensation for excess solar production during peak solar generation periods. However, the new commercial net metering program from Duke Energy allows C&I customers to install larger systems to meet their maximum demand, up to 5 MW.

OPPORTUNITIES

Breakout group discussing challenges and opportunities for North Carolina’s distributed solar market.

With all of the challenges brought up by participants, they also discussed a wealth of opportunities to grow the market, whether by circumventing challenges or tackling them head-on. Many of the opportunities relate to improving financial support for on-site generation, since decreasing the financial burden on customers would increase adoption of on-site solar. This can take the form of on-bill financing, interest rate buy-downs, new incentive programs with LMI-specific benefits, increased access to capital by combining different incentives and program assistance together for additive cost reductions, utilization of weatherization and resilience funding, and community-run Solarize programs for all customer sectors that can bring down installation costs through bulk purchasing.

Industry professionals can also take advantage of opportunities to improve their credibility and increase customer trust. Commitments to high-quality training and certification will reassure customers and improve the solar workforce. Allowing installers or energy managers to directly access customer energy usage data (with approval from the customer) could allow these third parties to offer insights and recommendations to customers without robust in-house energy management capabilities. In general, simplifying the process for customers to access their own data would allow customers to take full advantage of their on-site system and tailor energy usage or load shedding to their needs, the output of their system, and the TOU rate periods.

Workshop participants reporting out on their breakout group’s discussion of challenges and opportunities.

Finally, public and non-profit stakeholders have opportunities to advance the on-site solar market. Governments, whether state or local, can implement requirements for solar-ready buildings, or incentive programs to encourage voluntary compliance with solar-ready codes. They can also implement streamlined processes for permitting and inspection. Finally, establishing a single repository for information, regulations, and incentives available throughout the state would greatly benefit customers, advocates, installers, and developers. Centralizing all necessary information and resources can improve education and knowledge about on-site solar and reduce misinformation and misunderstanding.

Opportunities that were suggested by workshop participants, sorted by type of offered support:

| Financial Support | Industry or Utility Support | Government and/or Non-Profit Support |

|---|---|---|

| Expand On-Bill Financing to DERs | Installer Commitment to High Quality Training | Coordinated/One-Stop Shop for Information |

| Interest Rate Buy-Downs | Simplified Customer Data Access (Green Button) | Local Programs for Solar-Ready Buildings |

| Improved and Stable Incentives with LMI Carve Outs | Certified Installer Access to Customer Data | Consistent Permitting and Inspections |

| Tapping into Weatherization and Resilience Funding | Cohesive DER Advocacy Program | |

| Solarize Programs | ||

| Improve Access to Capital (Combining incentive programs) |

Although the on-site solar generation has historically lagged behind utility-scale solar development in North Carolina, the on-site generation market is ripe with potential. Despite concerns over challenges facing the market, participants see no lack of opportunity available. While some changes to the market are limited to state-level legislative or regulatory action, there are many actions that market participants can take to help advance on-site solar generation in the state.