By: Autumn Proudlove, Associate Director - Policy & Markets

With the end of 2023 upon us, our team likes to take the opportunity to look back on all of the policy and regulatory activity we’ve tracked through the year and think about some of the overarching trends and themes that we’ve seen. Across the areas of distributed solar, grid modernization, transportation electrification, and power decarbonization, our team tracked more than 2,500 actions taken by states and utilities this year, including introduced legislation, active regulatory proceedings, executive orders, and utility initiatives. From enabling virtual power plants and expanding clean energy targets to supporting building electrification and studying market reform, states and utilities took significant steps to advance clean energy in 2023.

Virtual Power Plants

One of the biggest buzz words of 2023 has been virtual power plant. The U.S. Department of Energy refers to virtual power plants as a “connected aggregation of distributed energy resource (DER) technologies.” This is an appropriately broad definition, as the term is being used to refer to a variety of technologies, ownership models, and use cases. Across the country, states, such as Colorado, have begun investigation virtual power plants, while utilities are actively proposing programs to aggregate DERs to provide grid services. In California, the California Energy Commission approved a new incentive program for customer-owned virtual power plants during 2023.

Expanding State Clean Energy Targets

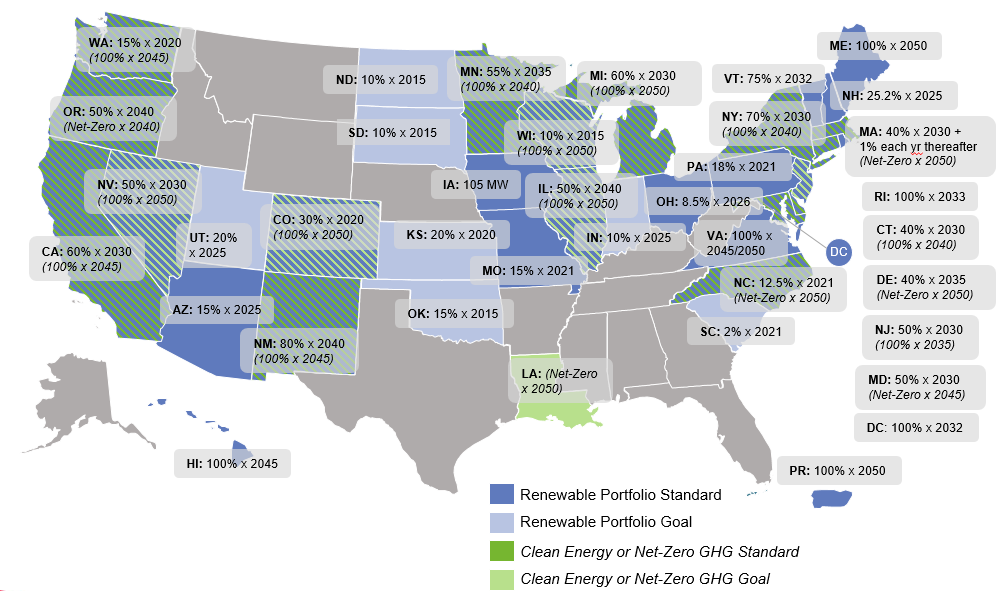

Although there has been little recent action in the way of establishing new renewable energy targets, there has been a trend toward expanding existing renewable portfolio standards (RPS) and setting broader clean energy standards. In 2023, both Minnesota and Michigan increased their RPS targets and adopted new 100% clean energy standards. Minnesota’s new targets are to achieve 55% renewable electricity by 2035 and 100% carbon-free electricity by 2040, while Michigan’s targets are to achieve 60% renewable electricity by 2030 and 100% carbon-free electricity by 2040.

State Clean and Renewable Energy Targets (Dec. 2023)

A number of states have also been setting emissions-based targets for the power sector or the state’s economy more broadly. In 2023, Delaware lawmakers adopted a new statewide target to achieve net-zero carbon emissions by 2050 and Colorado legislators set a goal of achieving a 100% reduction in statewide greenhouse gas emissions (over 2005 levels) by 2050, as well as a goal to achieve an 80% reduction in greenhouse gas emissions from retail electric sales (over 2005 levels) by 2030.

Low- and Moderate-Income Customer Access

A trend of the last several years that was especially prominent in 2023 was that of expanding clean energy access to low- and moderate-income (LMI) customers. One significant step taken this year was the release of the U.S. Environmental Protection Agency’s Solar for All RFP. States, tribes, local jurisdictions, and non-profits submitted applications to implement Solar for All programs, which will provide financial support for low-income households to install solar or participate in solar projects and achieve a 20% net bill savings.

Across the country, states and utilities also took wide-ranging actions to support LMI customer access to clean energy. Several states, such as Maryland and New Jersey, expanded LMI carve-outs for community solar programs, while other states adopted dedicated or enhanced clean energy incentives for LMI customers.

Building Electrification

States are increasingly taking a more holistic approach to decarbonization and developing strategies to address emissions from all major sectors. One sector receiving particular attention during 2023 was the buildings sector, with electrification generally considered the most promising pathway to decarbonization of this sector. Throughout 2023, states worked to design rebate programs, pursuant to the Inflation Reduction Act, that will support home electrification and energy efficiency. In New Jersey, the Governor signed an executive order setting a goal to electrify 400,000 additional residential units and 20,000 additional commercial or public facilities by 2030. Maine’s Governor set a new goal for the state to install an additional 175,000 heat pumps by 2027 after the state met its previous heat pump installation goal early.

Energy Market Reform

Energy market reform, and particularly participation in wholesale electricity markets, was a major topic of discussion during 2023. In South Carolina, a study commissioned by the general assembly found that the customers could save up to $362 million per year if the state joined the PJM Interconnection. The Arizona Corporation Commission also continued to explore options for wholesale market participation, with a study examining impacts of participation in the California Independent System Operator (CAISO) and the Southwest Power Pool (SPP). In Illinois, Ameren filed a study detailing the costs and benefits of remaining in the MidContinent Independent System Operator (MISO) or joining PJM.

Renewables Dominating Integrated Resource Plans

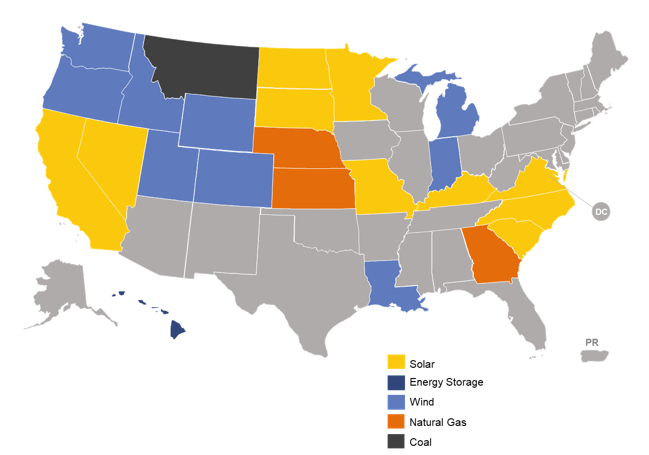

Numerous utilities filed integrated resource plans (IRPs) during 2023, which typically detail a utility’s plans for retiring and adding electric generation resources over the next 10 to 20 years. In IRPs filed or pending action by regulators in 2023, renewable energy resources dominated utilities’ planned capacity additions. In the third quarter of 2023, solar, wind, or battery storage were the largest planned resource addition in 20 of the 24 states with recent IRPs. Among these IRPs, planned solar additions totaled 82,971 MW, wind additions totaled 57,557 MW, storage additions totaled 39,116 MW, and natural gas additions totaled 27,501 MW. Coal retirements totaled 41,725 MW, while natural gas retirements amounted to 8,039 MW (see DSIRE Insight’s 50 States of Power Decarbonization report series for more).

Q3 2023 Utility Integrated Resource Plan Activity, by Largest Planned Resource Addition

Leveraging Inflation Reduction Act Funding

With a historic amount of funding for clean energy available through the Inflation Reduction Act (IRA), states are seeking opportunities to facilitate its use and multiply its impact in their jurisdictions. While some states are creating new incentive programs that can be stacked with IRA incentives, other states (such as Maine) are designing new programs with the intention of using federal funding to help support them. Another approach, taken by Minnesota, has been to establish matching funds to increase the state’s competitiveness in federal funding proposals.

Ownership of Electric Vehicle Charging Infrastructure

Another topic receiving attention across the country this year was ownership of electric vehicle (EV) charging infrastructure, and particularly the role of electric utilities in deployment of charging infrastructure. Regulators in Louisiana and Texas are currently considering whether utilities should be allowed to own EV charging stations, while Oklahoma lawmakers enacted legislation requiring that retail electric suppliers only own public charging stations through separate unregulated entities. Meanwhile, a number of utilities are pursuing “charging-as-a-service” programs, which typically involve customers paying a monthly fee for the use of a utility-owned charging station installed on their property.

Support for Emerging Technologies

State policymakers took several steps to support emerging energy technologies, such as advanced nuclear, offshore wind, hydrogen, and long-duration storage, during 2023. Connecticut policymakers expanded RPS eligibility to include advanced nuclear, while Maryland increased its offshore wind target. Maine lawmakers enacted legislation directing the Governor’s Energy Office to study long-duration storage, while the Massachusetts Department of Energy Resources kicked off its long-duration storage study this year. A number of states are also undertaking studies to consider the feasibility and role of these technologies.

Decommissioning and Land Use

Decommissioning and land use issues related to utility-scale renewable energy projects continue to be a topics of importance to state policymakers. Lawmakers in several states enacted legislation during 2023 establishing new requirements for planning, permitting, and decommissioning of projects. In Maine, legislators adopted requirements for the decommissioning of battery storage projects, while Michigan lawmakers passed a bill giving the Public Service Commission permitting authority for large renewable energy projects. In North Carolina, state legislators also approved new solar decommissioning requirements.