By: Vincent Potter, Senior Policy Analyst

Interconnection is a hot topic in the electric power sector. Indeed, new generator connections to the grid, the duration of the process, and the costs are long-running concerns for several parties. Federal and state regulators, independent power producers (IPPs), state legislatures, and utilities consider what reforms might be needed and how to implement them. Each of these entities present different, sometimes conflicting, perspectives on the needed changes to the interconnection process and the overall goal of reforms. Over the last three years, the DSIRE Insight team has noted an uptick in interconnection-related actions.

The Federal Energy Regulatory Commission (FERC) issued Order No. 2023 in November 2023 after a lengthy information gathering process on interconnection processes and needed reforms at the regional transmission and regulated utility level. Order 2023 seeks to implement changes which will reduce the time generators spend in the interconnection queue, provide a more equitable cost allocation for IPPs, and support new technological advancements. In advance of the requirements of Order 2023, several utilities around the country are taking action to reduce their interconnection queue times. In certain limited circumstances, state regulators have directed utilities to contract with engineering service companies to conduct studies and help move the interconnection process along.

Order No. 2023 seeks to reduce queue times in three ways. First, the transition from reviewing one project at a time (serial reviews) to reviewing several projects simultaneously (cluster reviews). In situations where utilities and transmission organizations have a long backlog of projects, reviewing several projects in tandem can expedite the process. Cluster review processes also allow cost sharing between projects within the cluster for engineering time and, if needed, infrastructure upgrades. Second, the order establishes a penalty for interconnection reviews that exceed established thresholds. This may incentivize transmission providers and utilities to bring on additional engineering staff or streamline internal coordination during the review process. Third, the order increases the financial surety requirements and increases penalties for leaving the review process early in order to limit the number of speculative projects that enter the queue to allow the studies to focus on projects with the greatest certainty.

Aside from queue duration, cost allocation is an important consideration for the parties in the interconnection reform discussion. The engineering studies have a cost that can be borne by individual interconnection applicants or by groups (often called clusters) of applicants. There are also network upgrade costs, the costs for the utility to upgrade its distribution and transmission infrastructure to support new projects, which have historically been largely borne by the one project which would exceed the system limits and necessitate the upgrade, irrespective of how many other projects recently interconnected and occupied the infrastructure capacity.

This cost allocation can be spread among several projects within a cluster of interconnection applicants seeking to inject power in a relatively close proximity. Division methods for these costs include project capacity or proportional impact basis. Project capacity is relatively straightforward, using the ratio of a project's capacity to the total cluster capacity to determine a percentage of the cost to be borne by each project. This is used in FERC's Order 2023 to allocate the costs of studies. Proportional impact is more complex; the total cost of all network upgrades for a cluster of projects must be determined, then the ratio of cost to the total infrastructure upgrade cost is used to assign percentage costs for upgraded substations and other components to support the projects.

Economic analysis has shown that renewables projects benefit from cluster studies and the associated shared cost allocation due to the locational concerns of the systems. A December 2023 National Bureau of Economic Review working paper by Sarah Johnston et al. "An Empirical Insight of the Interconnection Queue" analyzes the PJM Interconnection in particular, see here. New wind and/or solar projects are typically located where land is relatively inexpensive and their appropriate resource is abundant. This can place these projects far from population centers, and sometimes away from the infrastructure needed to carry large amounts of power to the population centers where the loads are greatest. If renewable projects are in a cluster with fossil fueled or other dispatchable generators that can be located closer to load centers, there will be a cost shift. Projects with lower network upgrade costs will subsidize projects with higher costs if they are reviewed within the same cluster. Many utilities create clusters for study on a temporal basis. Several utilities, including Duke Energy in the Carolinas and Xcel in Minnesota, are using a single annual cluster.

Energy Storage is Always a Little Different.

Generators like solar, wind, and natural gas have similar interconnection characteristics. They each inject power to the grid at a specified capacity. In the case of renewables like wind and solar, that power injection is predictable over time; they reliably add energy and power to the grid. Dispatchable generators, like hydro and gas, can provide power and energy when called upon and also other reactive load balancing services to the grid to stabilize fluctuations in the supply or demand of electricity.

2023 Activity on Energy Storage Interconnection Rules

Energy storage can enhance intermittent generators; it can complement solar or wind generation and provide reactive services. In Order No. 2023, FERC would have transmission providers allow projects to add storage to their design without losing their place in the interconnection queue. Specifically, storage can be added to designs as long as the new design does not change the project's capacity. This could be especially beneficial to renewable generators, adding some capability for dispatchable power output, as well as ancillary services, instead of relying only on their intermittent, if predictable, generation.

Commission Staff in Oregon proposed changes to the state's interconnection rules in mid-2023. The changes focus on storage paired with renewable generation. Instead of basing interconnection analysis on the aggregate nameplate capacity of the system (i.e. the storage capacity plus the generation capacity) the analysis would focus on the export capacity of the project.

National Picture

FERC's Order No. 2023 will affect all regional transmission organizations and all utilities providing transmission across state lines. However, utilities and regulators can consider various tweaks and reforms within their jurisdictions irrespective of FERC's orders. Utilities and transmission operators can maintain individualized rules for interconnection by seeking a variance from FERC from complying with all of the provisions of Order No. 2023.

2023 Activity on Commercial Solar and Storage Interconnection Rules

The Center does not formally track interconnection policies and actions in its Policy and Markets product portfolio. However, storage-related interconnection policies appear in the 50 States of Grid Modernization report series and the team does track some commercial solar interconnection activities. Last year, 26 actions tracked within DSIRE Insight involved storage interconnection policy consideration and over 40 commercial solar interconnection actions were pending as of the first quarter of 2024. Both legislatures and regulatory bodies are involved in proposing interconnection-related policy changes. Because interconnection rules are ultimately approved and enforced by regulators, the legislative actions provide instructions for the state utility commissions to implement reforms to interconnection processes within their jurisdictions.

Over the past three years, grid modernization policy actions tracked within DSIRE Insight have remained relatively similar. This report tracks policy developments in the areas of data access, demand response, energy storage, AMI, and storage interconnection. Each year, the quantity and proportion of interconnection-related policy actions have increased.

Hosting Capacity Example and Resources

Image Source: Xcel Energy Hosting Capacity Maps Minnesota

Hosting Capacity Maps, required in Order No. 2023, are overlays of circuits in the grid with notations for how much new capacity they can host before requiring upgrades. Maps like these are provided by several utilities and regional transmission providers to help IPPs determine which circuits might have the lowest cost and complexity for interconnection. Depending on the frequency that the maps are updated, they can be an invaluable tool to developers. The usefulness of maps also differs based on size and scale of projects: generators connecting to the transmission system tend to be larger and have much broader impacts than those connecting at the distribution level.

Image Source: Xcel Energy Hosting Capacity Maps Colorado

Xcel Energy provides hosting capacity maps for their distribution networks in Minnesota and Colorado, below. These maps are updated quarterly and are publicly accessible.

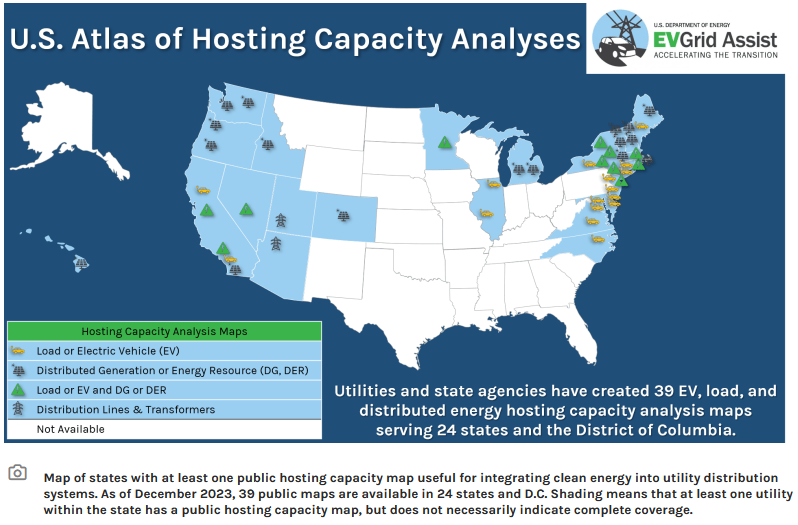

The US DOE publishes an "Atlas of … Hosting Capacity" which was last updated in January 2024. The Atlas catalogs states with available maps that can help integrate clean energy resources into utility distribution systems.

Image Source: U.S. Department of Energy

Cost Allocation Examples

Allocation of costs for system upgrades is a key part of Order No. 2023. Prior to the Order's publication, the Public Utilities Regulatory Authority in Connecticut undertook a cost allocation reform process via straw proposal. The Authority proposed to determine the upgrade costs for its distribution system as well as the total hosting capacity and have interconnection applicants pay a capacity-based percentage of those upgrade costs. Projects seeking to interconnect to congested areas (those with less than 25% of their hosting capacity available) would pay a premium on top of the established fee.

New Jersey lawmakers introduced a pair of bills in January 2024 that direct the Board of Public Utilities to update standards for renewable interconnections and develop fixed fees, much like the above in Connecticut. The bills require the Board to develop a capacity-based fee with a maximum for residential systems under 10 kW to $50/kW. Similarly, Vermont has a bill, pending since February 2023, directing its Commission to adopt rules ensuring a fair allocation of costs for grid upgrades.

As mentioned above, FERC included a proportional impact method in the network upgrade cost allocations for Order No. 2023. However, as Order No 2023 deals primarily with interconnection at the transmission level, the projects are likely to be larger and potentially have broader impacts than those seeking interconnections to the distribution system in Connecticut. That is to say, that for smaller scale projects, a capacity based system may have merits including simplicity of calculation and implementation compared to the more engineering-intensive proportional impact methods.

Future Interconnection Questions and Reform

The federal and state regulations and the utility policies focus largely on project development and engineering in their reforms. There are also non-engineering methods to reduce interconnection queues that are harder to prescribe for all utilities and transmission operators. Project management and administration limitations can delay projects moving from one study phase to the next and delay interactions with customers. Permitting ambiguity and site control issues can slow down initial applications when rules and local opinions about the project are unknown.

Interconnection policies, cost allocations, engineering study processes and timelines, and the effect of additional distributed generation on the grid will all have significant impacts on the energy transition. FERC's jurisdiction is on large interstate operations but smaller local projects are also affected by queue delays, limited hosting capacity information, and sometimes inequitable cost allocations.

Forthcoming programs like Solar for All and the Carbon Pollution Reduction Grants will supplement the efforts of the Inflation Reduction Act and the Bipartisan Infrastructure Law to further encourage the adoption of distributed energy generation, particularly rooftop solar and energy storage, for the next several years. The Solar for All program includes market development components. Award announcements are expected in the second quarter of 2024, interconnection rules for distributed energy systems are almost certain to be part of the discussions as the recipients begin their planning periods.

These programs all bear components which incentivize renewable adoption in lower income and disadvantaged areas. The cost allocation for upgrades needed to support expanded generation in these areas will be carefully considered. The bills like the ones in New Jersey and Connecticut seek to provide predictable costs for distribution-level interconnections. By including network upgrade costs in smaller energy systems, the energy offices and other entities implementing these grant programs may avoid surprises like unreasonable upgrade fees or insufficient hosting capacity availability.