By: Brian Lips, Senior Policy Project Manager

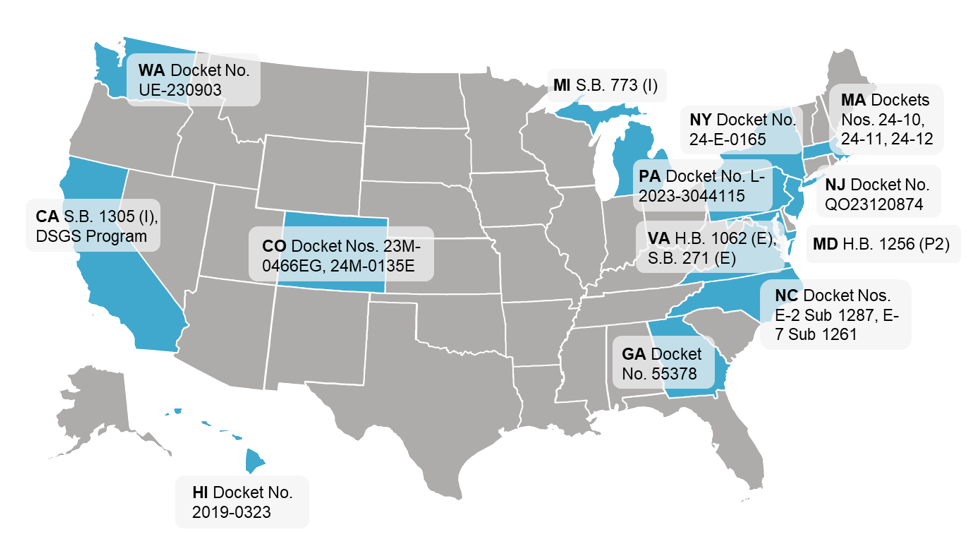

Virtual Power Plants (VPPs) are attracting a lot of attention at the moment. Our upcoming 50 States of Grid Modernization Q1 2024 report documents numerous policy and program actions taken by several states, and our very own Autumn Proudlove moderated a session on VPPs at the 2024 North Carolina State Energy Conference. Additionally, the U.S. Department of Energy published an extensive report on VPPs last year, and even mainstream media is publishing articles on their potential. But what exactly are VPPs, and what are states doing to enable their development?

VPPs can incorporate a variety of technologies with different characteristics, leading to the challenge of adequately defining them. However, all VPPs share the common elements of quantity and controllability. At their heart, VPPs involve the aggregation of a large number of distributed energy resources (DERs), which can be collectively controlled to benefit the grid and potentially obviate a utility’s need to activate a traditional peaking power plant.

The Smart Electric Power Alliance (SEPA) groups VPPs into three general categories: Supply VPPs, Demand VPPs, and Mixed Asset VPPs. Supply VPPs involve electricity-generating DERs, such as solar-plus-storage systems, which can be aggregated and controlled as a single resource when needed. Demand VPPs build off traditional demand response programs by aggregating curtailable load at a scale that can have a meaningful impact on the grid. Mixed Asset VPPs include a mix of both supply and demand resources.

While the benefits of VPPs are clear, the pathway to greater deployment is not. However, state policymakers are currently testing a variety of methods to encourage their development. Common approaches include a mix of mandates for utilities to procure energy from VPPs, incentives for utility customers to deploy DERs and participate in utility programs, and market access reforms to allow third-party aggregators to participate. Different varieties of these approaches have been considered by several states and utilities over the past year.

Recent Notable Virtual Power Plant Actions

California

The California Energy Commission (CEC) approved a new incentive program for VPPs in July 2023. The Demand Side Grid Support (DSGS) program compensates eligible customers for upfront capacity commitments and per-unit reductions in net energy load during extreme events achieved through reduced usage, backup generation, or both. Third-party battery providers, publicly-owned utilities, and Community Choice Aggregators (CCAs) are eligible to serve as VPP aggregators. At a minimum, each individual customer site participating in the program must have an operational stationary battery system capable of discharging at least 1 kW for at least 2 hours. Incentive payments will be made to VPP aggregators based on the demonstrated battery capacity of an aggregated VPP. VPP aggregators will then allocate incentive payments between the VPP aggregator and its participants based on their own contractual agreement.

California lawmakers are also currently considering legislation to stimulate the market for VPPs. S.B. 1305 requires the California Public Utilities Commission to estimate the resource potential of VPPs in the state, and to develop procurement targets for each utility to be achieved by December 31, 2028 and December 31, 2033.

Colorado

The Colorado Public Utilities Commission opened a new proceeding in September 2023 to explore third-party implementation of virtual power plant pilots in Xcel Energy's service area. The Commission issued a decision in April 2024 requiring Xcel to issue an RFP for a distributed energy management system (DERMS), which would then be used to manage a VPP. The Commission stopped short of directing Xcel to file a VPP tariff, but speaks of their merit and suggests that Xcel should propose separate “prosumer tariffs” for residential and non-residential customers, including different aggregation capacities.

Georgia

A stipulation agreed to by the Public Interest Advocacy Staff and Georgia Power in its 2023 Integrated Resource Plan Update proceeding commits the utility to developing a residential and small commercial solar and battery storage pilot program that will provide grid reliability and capacity benefits. Georgia Power will work with interested stakeholders to develop the program and will file it for approval with its 2025 Integrated Resource Plan.

Hawaii

In December 2023, the Hawaii Public Utilities Commission approved a new VPP program for the Hawaiian Electric Companies (HECO). The Bring-Your-Own-Device (BYOD) will replace HECO’s Battery Bonus Program and will provide varying levels of incentives based on the value of the grid services provided. The program will only allow energy storage systems at first, but may be expanded in the future to include other DERs.

Maryland

The Maryland General Assembly enacted a bill in April 2024, which opens the door to VPPs in the state. H.B. 1256 requires investor-owned utilities in the state to develop pilot programs to compensate owners and aggregators of DERs for distribution system support services. The programs must be filed for approval with the Public Service Commission by July 1, 2025.

Michigan

Michigan lawmakers introduced legislation in 2024 related to VPPs. S.B. 773 requires the Public Service Commission to develop requirements for programs that would allow behind-the-meter generation and energy storage owners to be compensated for services they provide to the distribution system, including through aggregators of DERs. Utilities would then need to file applications for these programs during their rate cases.

Massachusetts

In January 2024, the state’s three investor-owned utilities filed their Electric Sector Modernization Plans (ESMPs) with the Commission for approval. The three ESMPs include plans to invest in DERMS and customer programs to advance VPPs.

New Jersey

In December 2023, Public Service Electric & Gas (PSEG) New Jersey filed a petition for a VPP demonstration as part of its energy efficiency and peak demand reduction programs. The VPP demonstration will network behind-the-meter energy storage to provide grid services. The petition contains an energy storage incentive of $8,000 to $16,000 for 8 kW energy storage systems. Battery costs over the incentive amount would be eligible for on-bill repayments to PSEG.

New York

In April 2024, the Governor announced a new proceeding within the Public Service Commission to “develop a comprehensive New York Grid of the Future plan that establishes targets for the deployment of flexible resources such as virtual power plants and identifies the utility investments needed to enable the grid of the future.”

North Carolina

In January 2024, the North Carolina Utilities Commission approved Duke Energy’s application for PowerPair, a solar-plus-storage incentive program. Through the program, Duke Energy Carolinas and Duke Energy Progress will each provide incentives of $0.36/Watt for 30 MW of solar systems, plus $500/kWh for paired energy storage devices. Participants will be divided into two cohorts. One cohort will be on the utilities’ new Solar Choice Tariffs, which is coupled with time-of-use rates. These customers will retain complete control of their energy storage devices, but the time-of-use rates will incentivize them to configure them to provide energy during peak times. The other cohort will be on the utilities’ Bridge Tariff, which does not use time-of-use rates. These customers will grant full control of their systems to the utility to use as part of a VPP in exchange for an additional monthly incentive.

Virginia

Lawmakers in Virginia passed a pair of bills related to VPPs in 2024. H.B. 1062 and S.B. 271 clarify that customer-generators may participate in demand response, energy efficiency, or peak reduction programs from dispatch of on-site battery service, provided that the compensation received is in exchange for a distinct service that is not already compensated by net metering.

Washington

In November 2023, Avista Utilities filed a proposed tariff for the Spokane Connected Communities Pilot Program. The program will provide a variety of incentives to different customer classes for a mix of customer products including smart thermostats, residential energy storage batteries, building control systems, and heat pumps.

Looking Ahead

As trendy as VPPs are today, we are still in the early stages of their development. Wider electrification and the growing body of connected devices, in addition to the further proliferation of solar-plus-storage, will unlock more potential flavors of VPPs. Overtime, technological advances will also open the door to new policy solutions to better harness their benefits. With policymakers, utilities, and private enterprise working collaboratively to find solutions that work for a given state’s unique circumstances, we will surely see continued growth of VPPs.