What is the first thing you think of when you see the word cryptocurrency? For some, it's the economic opportunity, for others, it’s flat out confusion. Maybe, like me, your mind goes straight to Dogecoin, the crypto-meme that swept through social media a few years back. Regardless of what does come to mind, chances are it’s not energy usage, but maybe it should be.

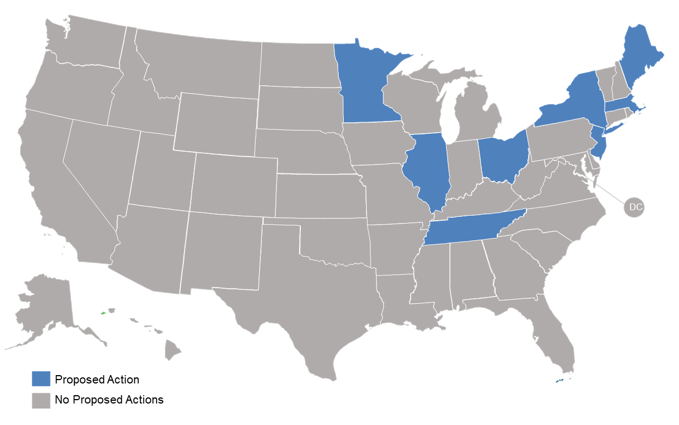

To Burn or Not to Burn: States Consider Blocking Gas Bans

The legislative year is well underway, and many states are essentially looking at one of two very different pathways: 1) prohibiting bans on fossil fuel-building infrastructure, or 2) banning fossil fuel-building infrastructure. Though some still have bills in limbo, others have already enacted laws this session that are primarily in support of the former and not the latter.

Nuclear’s Next Life

In the United States, civilian nuclear power has been a part of the energy mix since 1957. Since then, nuclear energy has gone through peaks and valleys, from economic slowdowns to regulatory shifts; and recently new power plant additions have been scarce. Nevertheless, through the fresh wave of incentives, pursuits of advanced reactors, and other nuclear technologies, nuclear’s future is being given a signal of support.

LMI Roundup: A Selection of New LMI Energy Policies and Programs Adopted in 2022

With the start of the new year comes a review of the past year. No one missed the historic passing of the Inflation Reduction Act, which included almost $400 billion dedicated to energy and climate change action. The programs and incentives in the Act were varied and wide-reaching, but this wasn’t the only major policy development to come about last year. States took action on everything you could possibly think of, and probably a few things you can’t! As time goes on, more and more governments are trying to make their policies increasingly inclusive, particularly by implementing rules to benefit low-to-moderate income, or LMI, residents. We’ll be taking a look through state-level actions throughout 2022 – the big and the small – related to LMI rules across various categories.

A Serving of Global Climate Diplomacy

There were a plethora of historic announcements made at COP27 and with the global climate event now wrapped up, commitments enter the phase of action. Looking forward, a significant number of these commitments could have substantial implications for the domestic and international clean energy industries.

NEVI NEVI Land

By: Brian Lips, Sr. Policy Project Manager

In September 2022, the Federal Highway Administration approved the National Electric Vehicle Infrastructure (NEVI) Program plans submitted by all 50 states plus DC and Puerto Rico. The plans detail how each jurisdiction will use their share of $5 billion in federal funding to deploy EV chargers along interstate highways over the next five years. Now that the plans are approved, states are moving forward with implementation.

State NEVI Program Funding (FY 2022 - 2026)

While the Infrastructure Investment and Jobs Act established many parameters for the resulting NEVI plans, it still left many decisions in the hands of the states. The state plans address these decision points, including the exact site locations, the prioritization for project sites, and the contractual mechanism the state will use to find a contractor.

Nearly every state anticipates issuing one or more requests for proposals (RFPs) to find third parties to install, own, operate, and maintain the charging stations. While some NEVI plans have a detailed timeline for when the state anticipates releasing the RFPs and awarding contracts, 19 states do not provide a clear timeframe for when they will release an RFP.

While the timelines provided by states in their NEVI plans are subject to change, many of them show a fairly aggressive schedule. Eight states (CO, KS, MI, OH, OR, VT, VA, and TX) plan to release an RFP by the end of 2022, though Ohio is the only one of these states to have done so as of mid-November. An additional eight states (CA, CT, LA, MT, NC, TN, WV, and WY) plus DC expect to release an RFP by the end of the Q1 2023. Hawaii and Nevada, meanwhile, already have contracts in place that pre-date their NEVI plans. These states plan to amend their existing contracts to incorporate the additional NEVI requirements, and may issue new RFPs in the future if needed.

|

State |

Timing for First NEVI RFP |

|

Alabama |

First half 2023 |

|

Alaska |

TBD |

|

Arizona |

Upgrades: Spring 2023 |

|

Arkansas |

Second Half 2023 |

|

California |

Q1 2023 |

|

Colorado |

November 2022 |

|

Connecticut |

Q1 2023 |

|

Delaware |

TBD |

|

District of Columbia |

Q1 2023 |

|

Florida |

TBD |

|

Georgia |

TBD |

|

Hawaii |

Existing contracts will be amended to include NEVI work. Additional solicitations may be considered in the future |

|

Idaho |

Spring 2023 |

|

Illinois |

TBD |

|

Indiana |

October 2023 - June 2024 |

|

Iowa |

Late Winter 2023 |

|

Kansas |

Dec-22 |

|

Kentucky |

TBD |

|

Louisiana |

Q1 2023 |

|

Maine |

TBD |

|

Maryland |

State Fiscal Year 2023 |

|

Massachusetts |

TBD |

|

Michigan |

Q4 2022 |

|

Minnesota |

Early 2023 |

|

Mississippi |

Fiscal Year 2023 |

|

Missouri |

2024 |

|

Montana |

Fall / Winter 2022 |

|

Nebraska |

TBD |

|

Nevada |

Existing contracts will be amended to include NEVI work. Additional solicitations may be considered in the future |

|

New Hampshire |

Fiscal Year 2023 |

|

New Jersey |

TBD |

|

New Mexico |

TBD |

|

New York |

TBD |

|

North Carolina |

Winter 2022 / 2023 |

|

North Dakota |

TBD |

|

Ohio |

October 2022, Proposals due 12/21/2022 |

|

Oklahoma |

TBD |

|

Oregon |

November of December 2022, may be delayed to early 2023 |

|

Pennsylvania |

Late 2022 / Early 2023 |

|

Puerto Rico |

Fiscal Year 2023 |

|

Rhode Island |

TBD |

|

South Carolina |

TBD |

|

South Dakota |

August 2023 |

|

Tennessee |

March 2023 |

|

Texas |

Fall 2022 |

|

Utah |

TBD |

|

Vermont |

Fall 2022 |

|

Virginia |

Q4 2022 |

|

Washington |

TBD |

|

West Virginia |

Winter 2022 / 2023 |

|

Wisconsin |

TBD |

|

Wyoming |

Fall / Winter 2022 |

While the build out of a fast charging network will form a vital backbone for transportation electrification across the United States, it is far from the only effort being undertaken by the states. States and utilities across the country continually roll out new approaches to further support the transition to electric vehicles. Check out DSIRE Insight’s 50 States of Electric Vehicles report series and Electric Vehicle Single-Tech Subscription offerings to stay on top of all of these developments.

Community Solar: Improving Economic Opportunities

By: Vincent Potter, Policy Analyst

What is Community Solar?

The U.S. Department of Energy (DOE) defines community solar as any solar project or purchasing program, within a geographic area, in which the benefits of a solar project flow to multiple customers, such as individuals, businesses, non-profits, and other groups.

Image: Co-op Power

Community solar programs can expand access to renewable energy for customers that cannot or choose not to install resources themselves. Participation in community solar programs does not require that customers own property, have ideal conditions on a site that they may own, or pay construction and siting costs for renewable generation installation. If offered in their area, customers may simply choose to subscribe to a desired amount of renewable electricity, pay a subscription fee, and receive bill credits from the energy generated from their portion of the community solar array.

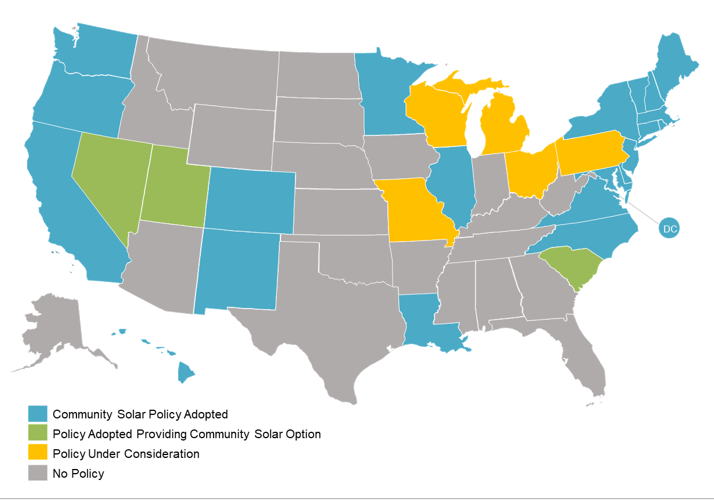

As of September 2022, 21 states have rules that require utilities or allow other entities to develop community solar programs.

Community solar programs can differ greatly from state to state, or utility to utility. Some programs are open to third-party development, others must be run by utilities. Subscription size limits, purchase options, and bill credit rates can all vary. Many programs have provisions for lower-income households.

Rules around community solar can be related to net metering policies, virtual net metering policies, or as entirely separate entities. In states without formal community solar program structures, utilities may choose to offer these programs. As of September 2022, 22 states and the District of Columbia had pending actions relating to community solar in their legislatures or before their utility regulators.

Benefits from Community Solar

Subscribers to community solar programs receive the renewable electricity that they desire. This can be a benefit in and of itself. In some locations, community solar is viewed as a "premium product" and therefore, subscribers are not expected to save money on their electric bills overall.

Policymakers and utilities throughout the United States are wary of "cross-subsidization" and tend to design programs such that only the beneficiaries pay. In North Carolina, community solar programs must not be supported by ratepayers that do not receive the benefits of the solar electricity generated. Ideally, subscribers would receive more tangible benefits, such as annual bill savings like net metered customers do. Community solar programs can be designed with participation or savings targets for lower-income customers. Lower-income households tend to pay proportionally more of their income for energy than wealthier households and community solar, which provides a bill savings, can offer relief.

In areas with regional transmission authorities, community solar operators can gain additional value from market participation. This participation in capacity markets or other ancillary services can reduce the subscription costs needed for projects to stay afloat, meaning that customers can potentially benefit as well. In regulated markets, ancillary services cannot be valued by open markets. If a community solar installation has a host that can benefit from demand reductions, those savings can be passed along to subscribers at the host's discretion.

Program Designs

Community solar programs throughout the United States use a range of different designs. Some programs sell the output of a panel for the life of the facility with a high up-front cost, similar to buying a solar panel and having it installed on the customer's property. Monthly and annual subscriptions are common options, which allow a smaller commitment from the customer but provide some additional uncertainty for the host. An additional common fee is an origination charge that would be imposed for the creation of new subscriptions.

Most community solar programs use an opt-in subscription design. This requires customers to choose to participate. The facility or subscription administrator would educate and/or advertise the services and benefits of community solar electricity under this program model. When community solar programs are "premium offerings" and provide subscribers with net costs, this program model ensures that participants make informed choices before getting a more expensive product.

Opt-out program design enrolls participants automatically. This design requires the subscriber to see a net savings or it creates a potentially unwanted additional charge on their energy bills. In New York and a few other states, this program design is used to ensure that lower-income customers can receive benefits from participation in community solar and similar programs without the necessity for educational and advertising campaigns by subscription administrators. This can reduce barriers to renewable electricity access, especially for lower-income households.

Image: ISO/RTO Council

Improving Benefits in the Southeast

Most of the Southeastern United States does not have access to a regional transmission organization that would allow easy market participation for community solar installations. Community solar facilities can provide additional benefits based on its host's electric service rates, especially if paired with energy storage. Cooperative and municipal utilities can experience significant savings from the coincident peak fees on their wholesale contracts. If community solar and storage systems are located strategically, they can also defer distribution system upgrades needed to support load growth on highly utilized infrastructure.

Research in North Carolina

Research conducted for the American Rescue Plan Act in 2022 analyzed the rate structures and wholesale contracts of several cooperative and municipal utilities in North Carolina. The research compared solar scenarios, battery sizes, and storage durations to identify general sizing and deployment strategies. The largest benefit found was in coincident peak reductions from solar and storage. None of the utilities analyzed had distribution infrastructure with forecasted load limitations that would create benefits from distribution deferral.

Municipal and cooperative electric utilities are non-profit entities owned by their customers. Benefits accrued through coincident peak or demand reductions can be shared between the utility and customers. Program design can set subscription fees and credit rates such that customers receive a net savings on an annual basis while allowing the utility to support program administration costs and operations & maintenance expenses. Net annual bill savings can make community solar more accessible and appealing to lower-income customers. However, additional barriers may hinder participation.

There are informational and administrative barriers for community solar facilities to make customers aware and acquire subscribers. Some amount of annual attrition should be expected as customers relocate or their preferences change. Opt-out program design, seen in New York and in a few other states, can significantly reduce these barriers. If the program's intent is to benefit lower-income households and community solar programs provide a net benefit for participation, then an opt-out program design, where lower-income subscribers are automatically enrolled as capacity becomes available, can fulfill that mission.

Conclusion

Community solar programs can provide tangible benefits not only to subscribers, but also host facilities and host utilities through demand charge reductions. When paired with energy storage, or optimally located within utility distribution infrastructure, the facilities can provide additional savings for their hosts. Program design can incorporate these host benefits and distribute a portion of them to subscribers to increase community solar participation benefits. To make benefit distribution more streamlined, an opt-out program model can be used to automatically enroll participants, reducing the administrative burden of subscriber acquisition. Opt-out programs require community solar program participation to result in subscriber savings to ensure that customers are not being drawn into a program which actually increases their bills, a particularly difficult prospect for lower-income households.

Keep up with legislative and regulatory changes related to data access with the 50 States of Solar report or DSIRE Insight’s Single-Tech Solar Subscription.

The Good Kind of Global Heating (and Cooling)

By: Justin Lindemann, Policy Analyst

Header image created by Justin Lindemann

Climate resiliency has been impaired due to frequent extreme temperature changes and storms, putting much of our infrastructure under pressure – heating and cooling especially. Cheaper and more efficient technologies are thus required to meet demand and keep communities safe. This is a dilemma that may be answered by a long-existing innovation, the heat pump.

An Introduction to Heat Pumps

While heat pumps have been around for decades, recent climate imbalances have made the technology an important alternative to more traditional fossil-fuel powered furnaces and heating/cooling systems. The idea for a heat pump can be traced back to the mid-18th century, with the first having been developed almost a century later.

There are a variety of heat pump types, each with the functionality to heat and – though the name might be a bit deceiving – cool communities and industries, reducing energy inefficiency while saving money. Water-, ground-, and air-source heat pumps are the three main types of systems. Water-source pumps extract and reject heat from water systems, with temperatures depending on the season. Ground-source pumps utilize earth’s constant temperature to heat and cool, extracting heat during the winter months and earth’s cooler temperatures during the summer, from several feet underground.

Then there are air-source (or air-to-air) pumps, which are the most commonly employed heat pumps today. Air source pumps come in either ductless or ducted versions, depending on whether the space in question has access to an existing duct system. As its name suggests, this type extracts ambient air temperature to heat/cool buildings.

Air-source pumps consist of an indoor and outdoor coil to help transfer heat. When heating, a refrigerant absorbs the ambient heat and evaporates it into a gas utilizing a compressor, shifting the heat through an inside coil and releasing the air into the space. After that, the vaporized heat returns as a liquid, and goes through an expansion device and back out – becoming different in pressure and temperature. The system’s reversing valve is responsible for switching between heating and cooling modes. The diagram below visualizes the process, and has similarities to water- and ground-source types.

Source: U.S. Department of Energy

Compared to the many furnace systems in the U.S. that run on fossil fuels, heat pumps run on small amounts of electricity (with more used during the winter) and can easily utilize distributed energy sources – like rooftop solar. Over the course of 15 years, switching to a heat pump can potentially save the average U.S. homeowner around $10,000 in upfront costs and energy bills.

Moreover, the absence of burning fossil fuels reduces emissions, which can help mitigate climate change and bear community health benefits. Low-income and BIPOC (Black, Indigenous, People of color) communities that face higher bouts of climate injustice would be impacted less by fossil fuel infrastructure and the resulting atmospheric pollution, if this and other cleaner tech were to be adopted. The recently passed Inflation Reduction Act (IRA) provides multiple incentives to help achieve these benefits.

The IRA and a Burgeoning Industry

The heat pump incentives stipulated in the IRA are spread out into various programs. Firstly, the extended Energy Investment Tax Credit (ITC) credits 30% for geothermal heat pump projects built before January 1, 2033, with the credit decreasing to 26% and 22% in 2033 and 2034 respectively. There is a 10% bonus if the project is located in energy communities, otherwise defined as brownfield sites and fossil fuel communities, and another 10% if the project meets domestic manufacturing requirements. The Energy ITC will be replaced by the new Clean Electricity Investment Tax Credit beginning in 2025. The tax credit maintains the 30% geothermal heat pump incentive (and all other provisions stipulated under the Energy ITC). In addition to the aforementioned bonuses, the improved incentive provides an additional 10% for projects in low-income communities or on Tribal lands, and 20% for those located in low-income residencies or connected to low-income economic benefit projects.

The IRA also includes amendments to the Residential Energy Efficiency Tax Credit, increasing the credit limit for heat pumps to $2,000 (or 30% of the cost, if lower) and extends it to the end of 2032. Likewise, the High Efficiency Electric Home Rebate Program in the landmark legislation provides up to $8,000 and $1,750 for heat pumps and heat pump water heaters, respectively. The nation’s heat pump production will also be supported through $500 million in Defense Production Act spending, available until September 30, 2024.

Besides the influx of federal support from the IRA, state incentives have existed to support clean technologies like heat pumps. Warmer-climate states have historically had a higher percentage of housing with heat pumps, due to the South being mostly electric-reliant for heating and cooling. States like South Carolina, North Carolina, and Alabama have the highest percentage of heat pumps, while Texas and Florida have the highest number installed. Considering the South has the highest number of low-income communities, continual adoption of heat pump technology could be particularly beneficial.

In Texas, about 38 financial incentives are currently available for heat pumps, with most being offered by utilities. One of these incentives is Southwestern Electric Power Company’s (SWEPCO) Residential Energy Efficiency program, which reduces the upfront cost for residential consumers by providing a rebate for selected contractors.

As for Northern, colder-climate states, they haven’t adopted heat pumps at the rate of others, primarily due to older variations of the technology underperforming under freezing temperatures. However, with innovations raising the resiliency and efficiency factor of the technology's heating mode – in addition to incentives and federal funding – more might be persuaded to invest. In fact, a study released this year by the American Council for an Energy-Efficient Economy (ACEEE) showed that heat pumps will be the cheapest clean option to heat most single-family homes in the U.S. Similarly, a Guidehouse Insights report details a projected heat pump market valuation of $3.31 billion in 2031 amongst North America’s colder regions.

In terms of colder-climate examples, Minnesota has the greatest number of incentives of any state. But, the North Star State’s percentage of households with heat pumps isn’t comparable to that of the South. Most of the state’s incentives are delivered through rebate programs from utilities (especially municipalities and cooperatives). The Minnesota Municipal Power Agency (MMPA), which covers a dozen member communities, offers a rebate through its Residential Energy Efficiency program. The program is for those looking to upgrade specific household equipment, and offers $200 off each Energy Star certified air-source unit.

Europe’s Energy Crisis and Global Developments

Across the Atlantic, the combination of the war in Ukraine and climate concerns has pressured Europe to act on multiple fronts. Before war broke out, Europe imported 45% of its gas from Russia for energy and heating purposes. Military operations between Ukraine and Russia have influenced Europeans to gradually wean off Russian fossil fuels, while putting the continent in a tough spot as winter temperatures approach. Fortunately, the International Energy Agency (IEA) has estimated that a European heat pump rollout could reduce Russian gas reliance by two billion cubic meters in one year. This is exactly what the continent is striving for as it is projected to install 45 million residential heat pumps by 2030, with multiple nations already on course.

In Poland – a nation that grew quite dependent on Russian gas, alongside its own domestic supply of coal – household fervor for home upgrades has increased amidst the energy crisis. With the nation suffering a coal shortage before the influx of winter, more and more have decided to pull the trigger and install a heat pump. In 2021, the Polish heat pump association reported a 60% increase, months before the war in Ukraine. The coal-reliant nation updated its incentives this year, offering up to €15,000 for households wanting to modernize their heating and insulation.

Italy, on the other hand, offers one of the biggest financial incentives in Europe. Their stimulant recovers 110% of building renovation costs for home energy efficiency projects, including heat pumps. The initiative was authorized in November 2020 to help with their pandemic recovery and to convert existing infrastructure into resilient and energy efficient spaces. This and other actions have helped the Mediterranean nation reduce Russian gas dependency from 40% to 25%.

Yet, it is the Scandinavian nations with the coldest climates that have a higher percentage of heat pumps. In Norway, Sweden, and Finland, the percentage of households with heat pumps is about 60%, 43%, and 41%, respectively. The fact that countries with average winter temperatures of negative degrees Celsius have had such success offers additional support for why colder regions in the U.S. may be able to take greater advantage of heat pump technology.

Image (above) of a ductless air-source heat pump (Source: U.S. Department of Energy)

Internationally, other nations have had a build-out years in the making. Japan, for example, has one of the highest energy efficiency rankings, thanks in part to the 90% of households that use heat pumps. As a result, the country’s electricity consumption has dropped 40% in the past decade. Meanwhile, in China, heat pumps for cooling are common in northern urban provinces. During the winter, large scale heat pump networks, otherwise known as district heating, cover 80% of the region’s population. The IEA estimates the current global number of installed heat pumps to be at about 1.5 million per month, and projects 5 million per month in 2030.

What does the future hold for heat pumps?

Heat pumps are a clean, affordable, and efficient substitute for traditional fossil fuel furnaces and other heating/cooling systems. The growing interest in the technology has influenced many nations to establish incentives and make it more affordable, as communities try to scale up their resilience. The clean technology has the mechanical quality of providing both heating and cooling, and has been successfully tested in numerous climates. The flexible application mixed with the different kinds of heat pumps available gives the technology an advantage over fossil fuel alternatives. All in all, heat pumps are gradually becoming a staple for heating and cooling.

* * *

For more information on heat pump policies and incentives, visit the Database of State Incentives for Renewables and Efficiency (DSIRE), or contact us to learn about custom research offerings.

The Many Incentives for Homeowners in the Inflation Reduction Act

By: Brian Lips, Sr. Policy Project Manager

The Inflation Reduction Act of 2022 (H.R. 5376) is a sweeping piece of legislation, representing the largest ever investment in renewable energy, energy efficiency, and electric vehicles by the federal government. The bill extended and modified a number of existing tax incentives with new requirements or bonuses to favor or require onshore manufacturing, development within disadvantaged communities, and the use of fair labor practices. Congress also addressed challenges historically faced by non-profits and other tax-exempt entities by making new mechanisms to monetize the tax credits through direct pay or a transfer to an unrelated taxpayer. The bill also established several new incentives and appropriated funding to various federal agencies and state governments to further incentivize renewable energy, energy efficiency, and electric vehicles.

While there are many key provisions in this bill, and DSIRE is being updated to incorporate all those that fit within its scope, this article focuses on the provisions of the bill that target the residential sector. As a result of the Inflation Reduction Act, there are now five tax credits that can benefit a homeowner or a prospective car owner, as detailed below. Additional incentive programs will also be made available through state energy offices using targeted appropriations from the bill.

Electric Vehicles

In its current form, the Plug-In Electric Drive Vehicle Tax Credit awards a tax credit of up to $7,500 to taxpayers who purchase a new electric vehicle. The credit is designed to decrease over time for each manufacturer as they produce more electric vehicles. The Inflation Reduction Act extended the tax credit through December 31, 2032, but adopted new rules that fundamentally change the tax credit and the vehicles that will qualify for it. Beginning on January 1, 2023, electric vehicles will only qualify for a tax credit if the final assembly occurs in North America and certain components meet the sourcing requirements established by the bill.

Vehicles purchased in 2023 will qualify for a tax credit of $3,750 if 40% of the critical minerals used in their batteries are extracted and processed in the U.S. or another nation with which the U.S. has a free trade agreement, or the batteries are recycled in North America. These percentages increase over time. Vehicles can qualify for an additional $3,750 tax credit if an increasing percentage of battery components are manufactured and assembled in North America. The bill also caps the purchase price of vehicles and adjusted gross income of taxpayers to be eligible for the credit, and establishes a mechanism for the credit to be transferred to the vehicle dealer in exchange for a point of sale discount to the buyer.

The Previously-Owned Clean Vehicle Tax Credit is a new tax credit adopted by the Inflation Reduction Act for used electric vehicles purchased by a qualifying taxpayer after December 31, 2022. The credit is worth the lesser of $4,000 or 30% of the sale price. The model year of the vehicle must be at least two years earlier than the calendar year in which the taxpayer acquires it, and the vehicle must have a gross vehicle weight of less than 14,000 pounds. The transaction must take place through a dealer and carry a sale price of $25,000 or less, and be the first transfer since the establishment of this tax credit. The credit is not available for taxpayers with a modified adjusted gross income exceeding: $150,000 for a joint filing, $112,500 for a head of household, or $75,000 for a single filing. As with other tax incentives, the Inflation Reduction Act established a mechanism for a taxpayer to transfer this credit to the dealer in exchange for a point of sale discount.

The Alternative Fuel Vehicle Refueling Property Tax Credit provides a tax credit for the purchase of residential and commercial electric vehicle chargers, but it expired at the end of 2021. The Inflation Reduction Act reinstated the credit for purchases made in 2022 and extended the expiration date to December 31, 2032. Residential chargers can qualify for a tax credit of 30% of the cost up to $1,000. Equipment purchased for a non-residential purpose must meet certain labor requirements to qualify for the full 30% tax credit, but residential chargers do not.

Renewable Energy and Energy Efficiency

The Residential Energy Efficiency Tax Credit was created by the Energy Policy Act of 2005, and provides a tax credit for certain energy efficient purchases by homeowners. While the credit previously had a lifetime cap of $500 and periodically expired altogether, the Inflation Reduction Act extended it through December 31, 2032 and increased its value for purchases made after December 31, 2022. The lifetime cap for the credit was removed in favor of caps on the amount of tax credit for each individual purchase or improvement, and an annual cap of $1,200 with some exceptions. Natural gas or electric heat pumps and natural gas or electric heat pump water heaters can qualify for a 30% tax credit up to $2,000. Other qualifying water heaters and HVAC equipment can qualify for a tax credit of 30% up to $1,200. Building envelope improvements, including windows, skylights, doors, insulation, and air sealing can also qualify for tax credits.

The Residential Renewable Energy Tax Credit was also created by the Energy Policy Act of 2005, and provides a tax credit for renewable energy equipment purchased by homeowners. Previous legislation had established a phaseout of the credit, decreasing to 22% in 2023 and expiring completely in 2024. The Inflation Reduction Act delayed the phaseout of the credit and extended the expiration date. Eligible equipment placed in service by December 31, 2032 can receive a tax credit of 30%. The tax credit is scheduled to decrease in 2033 and 2034, and then expire altogether in 2035. The Inflation Reduction Act also made standalone energy storage systems eligible for this tax credit for the first time.

Residential Tax Credits Available in 2023

|

Equipment Type |

Incentive |

Maximum Incentive |

|

New Electric Vehicles |

$7,500 |

$7,500 |

|

Used Electric Vehicles |

30% |

$4,000 |

|

EV Chargers |

30% |

$1,000 |

|

Windows and Skylights* |

30% |

$600 per year |

|

Exterior Doors* |

30% |

$250 per door, $500 per year for all doors |

|

Insulation* |

30% |

$600 per year |

|

Air Sealing* |

30% |

$600 per year |

|

Natural Gas or Electric Heat Pumps |

30% |

$2,000 |

|

Natural Gas or Electric Heat Pump Water Heaters |

30% |

$2,000 |

|

Central Air Conditioners* |

30% |

$1,200 |

|

Gas, Propane, or Oil Water Heaters* |

30% |

$1,200 |

|

Gas, Propane, or Oil Water Boilers* |

30% |

$1,200 |

|

Biomass Stoves |

30% |

$,2000 |

|

Panelboards, Sub-panels, Branch Circuits associated with an above efficiency improvement* |

30% |

$1,200 |

|

Solar PV Systems |

30% |

N/A |

|

Solar Water Heaters |

30% |

N/A |

|

Fuel Cells |

30% |

N/A |

|

Small Wind Systems |

30% |

N/A |

|

Geothermal Heat Pumps |

30% |

N/A |

|

Stand-Alone Battery Storage Systems |

30% |

N/A |

* Tax credits for these items are subject to a collective annual cap of $1,200 per taxpayer

Future Incentives

The Inflation Reduction Act also appropriated money to establish rebate programs at the state-level for residential energy efficiency improvements. The bill distributes $4.3 billion to state energy offices through 2031 to implement Home Energy Performance-Based Whole-House Rebate (HOMES) programs. The state energy offices will determine the final design of these programs, but the Inflation Reduction Act provides the broad parameters and sets the maximum incentive levels. The programs will target individuals and aggregators carrying out energy efficiency upgrades of single-family or multi-family homes with incentives based on the modeled energy savings of the retrofits. Retrofits to single-family homes that achieve modeled energy savings of 35% or more can receive a maximum rebate of $4,000 or 50% of the project costs, whichever is less. Retrofits to multi-family homes that achieve modeled energy savings of 35% or more can receive a maximum rebate of $4,000 per dwelling unit, with a maximum of $400,000 per building. Larger incentives will be available for qualifying low- or moderate-income houses.

The Inflation Reduction Act also appropriated $4.5 billion to state energy offices and tribal governments to implement prescriptive energy efficiency rebate programs through the High-Efficiency Electric Home Rebate Program. As with the HOMES program, the Inflation Reduction Act establishes the general guidelines for the program and the maximum incentives that the resulting programs can provide. The bill also includes a list of the appliance types and non-appliance upgrades eligible for incentives through the program, including heat pumps, heat pump water heaters, electric stoves, cooktop ranges, electric heat pump clothes dryers, insulation, air sealing, ventilation, and electric wiring. The bill also requires state energy offices to make these incentives available as point-of-sale rebates.

State energy offices will need to submit their plans for these rebate programs and have them approved by the Department of Energy before they can implement them. It is unclear how quickly these programs will be made available, but they will be separately listed by state in DSIRE as soon as they are approved.

Current Trends in U.S. Hydrogen Policy

By: Rebekah de la Mora, Policy Analyst

With the passing of the Infrastructure and Investment Jobs Act of 2021, $8 billion dollars worth of focus was placed on the most abundant element in the universe: hydrogen. Specifically, hydrogen used for energy purposes. Some may know a significant amount about hydrogen energy; some may know of it only through the disastrous Hindenburg accident of the 1930s; and some may know nothing at all. Some find it to be a waste of time and resources, some find it to be a key solution in the fight against climate change, and some find it to be a solution like any other. Hydrogen is not as in the public sphere as energy sources like natural gas, wind, or solar, but discussions surrounding it are becoming more and more prevalent.

What is Hydrogen Energy?

While hydrogen is always made of the same component -- H2 molecules -- the ways to get there vary. When talking about said ways, they are categorized by color. The colors refer to the process used to make the hydrogen and the energy source, or "feedstock." Black, brown, and gray hydrogen refer to steam methane reformation or gasification using coal or natural gas/methane; blue hydrogen is the same, but with the addition of carbon capture and storage. Green hydrogen refers to electrolysis using renewably-sourced electricity; pink or purple hydrogen also uses electrolysis but with nuclear-sourced electricity, while yellow hydrogen is specifically solar-sourced electricity only. Turquoise hydrogen refers to methane pyrolysis using natural gas/methane; this method is not yet at-scale. White hydrogen refers to naturally-occurring or fracking-created hydrogen that is "mined" for use; this method is more theoretical and not yet in practice. Policies on decarbonization-via-hydrogen tend to focus on green hydrogen, with blue hydrogen also relatively popular. Many policies may use the phrase "clean hydrogen," which often implies green, pink/purple, yellow, and occasionally blue.

The end-uses of hydrogen vary, and do not depend on the color. Overall, its uses fall into three main categories: replacing carbon-intensive sources of energy, a component in product manufacturing, and energy storage. First, hydrogen can be used as an alternative fuel in transportation; depending on the exact technology, hydrogen-powered vessels like boats or heavy-duty trucks are more feasible than electric versions. Hydrogen can also be used to decarbonize various industrial processes, particularly hard-to-decarbonize sectors like steel. Hydrogen can even be blended with natural gas for heating purposes. Second, hydrogen is a major component in ammonia and fertilizer production for agricultural use. Third, hydrogen can be used as a form of energy storage, "storing" electricity until it is needed, at which point the hydrogen undergoes reverse electrolysis to generate electricity. Hydrogen is often seen as a solution for long-term or long-distance storage; for example, storing solar power from summer to be used in winter, or importing green hydrogen from another country to provide renewable energy.

Hydrogen in State and Federal Policy

At the subnational level, many states are attempting to include hydrogen in their clean energy policies. One of the easiest actions is including appropriations for hydrogen in state budgets. Hydrogen is often integrated into alternative fuels or electric vehicle programs, from providing incentives for fuel cell cars to encouraging development of heavy-duty hydrogen vehicles. In conjunction with the regional hubs initiative, many states are establishing studies, working groups, or committees to look at hydrogen infrastructure and feasibility. Hydrogen is also being included in policies related to GHG reductions and transportation decarbonization, specifically clean hydrogen; energy targets are also incorporating clean hydrogen or hydrogen from renewable sources as an eligible energy source.

At the national level, the Infrastructure and Investment Jobs Act of 2021 provides $8 million in DOE funding to develop regional hydrogen hubs across the US. The money is expected to fund 4-8 regional hubs. The law requires that the hubs vary their feedstocks, end-uses, and geography to ensure a variety of hydrogen frameworks are put into practice. Many states have begun collaborative efforts to receive the funding, signing agreements or memorandums with neighboring states and organizing groups to respond to DOE's Request for Information on the subject. At least 18 states have officially declared their intentions to pursue the funding, of which there are 4 regional agreements: Arkansas, Louisiana, and Oklahoma; Colorado, New Mexico, Utah, and Wyoming; Connecticut, Massachusetts, New Jersey, and New York; and North Dakota and South Dakota. The other states have declared their intent, but have not signed an agreement with other state governments to pursue a joint regional hub. Some states have expressed interest via stakeholder workshops or private-sector interests, like the Southeast Hydrogen Energy Alliance in the Carolinas, but have not yet officially declared their intentions. The application period is expected to open in Fall 2022.

The hydrogen economy is slowly gaining ground as private and public sector interests look for alternatives to fossil fuels; it is an especially notable solution for hard-to-decarbonize sectors or places with low possibilities of renewable energy integration. While hydrogen is not yet as ubiquitous as traditional renewable technologies, nor has the same level of resounding support, the growing prevalence of hydrogen in energy policy demonstrates a trend that is here to stay.

Electric Power Decarbonization: State Policies and Recent Actions

By: Autumn Proudlove, Sr. Policy Program Director

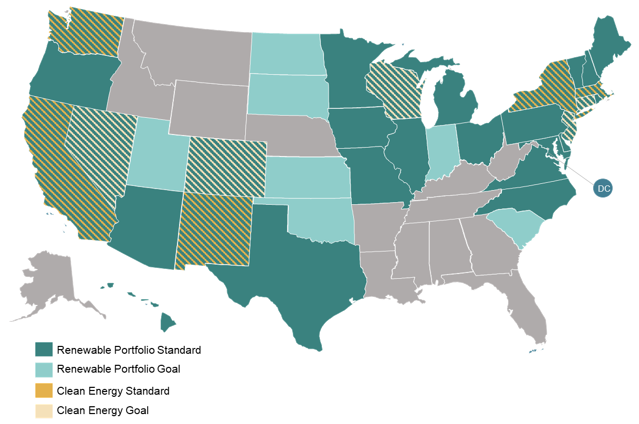

States continue to be very active on clean energy policy, with a growing focus on overall decarbonization of the electric power sector. Some of the most popular policy approaches to electric decarbonization are renewable portfolio standards, clean energy standards, and emissions reduction targets. Currently, 36 states and DC have a renewable portfolio standard or goal, while 10 states have a clean energy standard or goal. Numerous states have also adopted requirements or goals to reduce carbon or greenhouse gas emissions by a certain percentage. Some of these emissions reduction policies apply to the electricity sector specifically, while others apply economy-wide.

State Renewable Portfolio Standards and Clean Energy Standards

Recent Activity

A number of states have recently considered legislation to increase their decarbonization targets or set new targets. The Hawaii State Legislature passed H.B. 1800 this year, which would adopt a statewide greenhouse gas emissions reduction target of 50% over 2005 levels by 2030. The bill is currently awaiting action by the Governor. In Rhode Island, H.B. 7277 and S.B. 2274 would increase the state’s renewable portfolio standard to 100% by 2033. The bills have been passed and are also awaiting action by the Governor. The Maryland General Assembly enacted the Climate Solutions Now Act of 2022 (S.B. 528) in April 2022, which adopts a target of net-zero statewide greenhouse gas emissions by 2045.

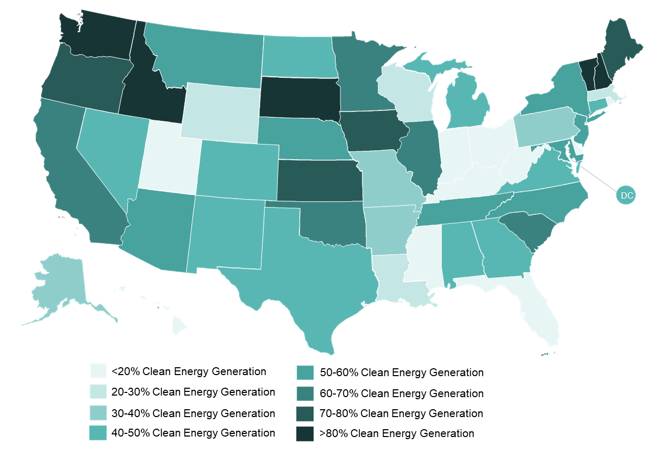

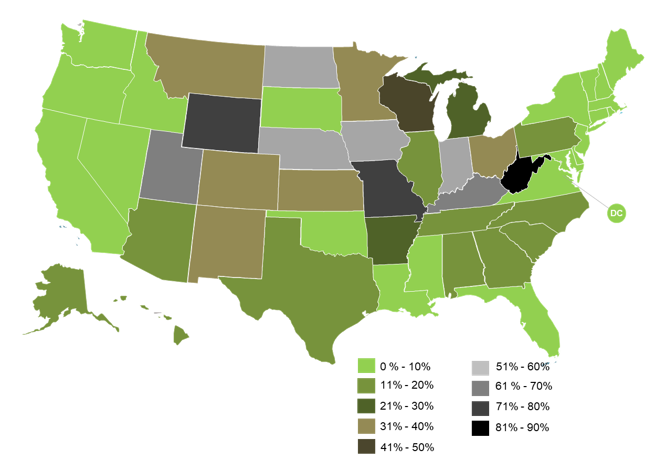

Current Clean Energy Generation by State (Data Source: U.S. Energy Information Administration)

Current Clean Energy Generation

The amount of electricity being generated by clean sources varies significantly from state to state. The map above shows the percentage of electricity generation currently coming from clean energy sources, with data derived from the U.S. Energy Information Administration (Electric Power Monthly, Net Generation by State by Type of Producer by Energy Source, March 2022). The map represents the percent of total MWh generated in each state from nuclear, hydroelectric, solar, wind, biomass, and geothermal sources. The dominant clean energy resources also vary substantially from state to state. For example, hydropower is a major contributor in the Northwest and wind accounts for a large portion of generation in the Midwest and Plains states.

While states are at different stages of electric power decarbonization, the general policy trend across the U.S. has been toward more aggressive targets - increasing emission reduction or clean energy goals and speeding up the timeline for achieving these. Utilities themselves are also setting their own goals, as identified by the Smart Electric Power Alliance’s Carbon Reduction Tracker. With the majority of states having some type of a decarbonization target in effect, even many 100% clean energy or net-zero emissions goals, integrated resource planning and market rules will be important areas to watch as implementation of these policies unfolds.

* * *

The DSIRE Insight team is currently developing a new policy tracking report series - The 50 States of Decarbonization - which will track state decarbonization policy developments and utility planning. Sign up for our email list to be the first to know when the new series is available, or contact us to learn more.

Recent Developments in Managed Charging

By: Brian Lips, Sr. Policy Project Manager

A record 434,879 electric vehicles (EVs) were sold in the U.S. in 2021. Facing growing demand, manufacturers continue announcing new models to further electrify the transportation sector. This surging market will surely help states meet their climate goals, and open new business opportunities for electric utilities. But could a new source of electricity demand be more of a detriment to utilities, which, in some states, already have challenges meeting their peak demands? The California Energy Commission, for example, projects EV charging will add an additional demand of nearly 1,000 MW before 8:00 PM on top of the already challenging duck curve.

With no other market interventions, EV owners who commute to work could be inclined to charge their vehicles when they return in the late afternoon and exacerbate these growing demand curves. However, with proper incentives or more direct utility involvement to shift the EV demand curve, EV charging could provide a myriad of benefits to consumers and the electric system as a whole. While the EV industry and its effects on the grid are still very new and vary from state to state, utilities have started exploring different approaches to influence customer charging behavior, commonly referred to as managed charging.

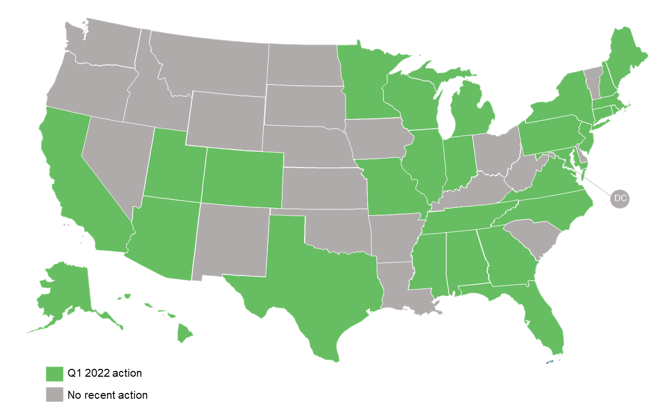

Q1 2022 State and Utility Action on EV Rate Design & Managed Charging

The Smart Electric Power Alliance draws a distinction between active and passive managed charging, which are analogous to the existing utility approaches to managing demand generally. Passive managed charging uses price signals like time-varying rates or peak time rebates to encourage customer behavior, while active managed charging gives utilities direct control over the load similar to a demand response program.

The 50 States of Electric Vehicles quarterly report series tracks ongoing efforts by state policymakers and utilities to expand the market for EVs, including proposals from utilities for managed charging programs. To date, the majority of utility proposals identified in the 50 States of Electric Vehicles reports have been passive managed charging. But several utilities have taken action in recent months to roll out active managed charging programs.

Duke Energy filed an application with the North Carolina Utilities Commission in February 2022 for a new managed charging pilot program. The pilot program combines a fixed monthly subscription rate for residential EV charging with a managed charging element. Customers will be able to charge their vehicle whenever and however often they like, but will receive a warning from Duke if they consume more than 800 kWh in a month. Meanwhile, Duke will have the right to pause a customer’s charging for up to four hours three times per month. Duke believes customers will be attracted to the predictability of a set monthly fee, while the managed charging aspects of the program will limit its negative impacts on the system.

In Wisconsin, Madison Gas and Electric filed its own application in March 2022 for three new managed charging pilot programs. The programs separately target apartments and workplaces, fleets, and single-family residential customers. Through the pilot programs for apartments and workplaces and fleets, the utility will own and install charging equipment at customer sites in exchange for a monthly fee, which ensures there is no cross-subsidization from non-participating customers. Participants will then receive an annual credit of $40 in exchange for the utility having remote access to control their charging. The single-family residential program builds off of the utility’s existing Charge@Home program, but targets customers who charge at home with a 240-volt cord instead of installing a charging station. Without a charging station, Madison Gas & Electric cannot manage the customer’s charging through the Charge@Home program, but the new program gives that control to the utility through telematics.

The managed charging programs in existence today and those being actively considered by utilities and regulators use different incentive structures and design features to achieve the same result. Utilities and stakeholders alike want to shift customer charging behavior to limit the potential negative impacts of increased demand, and instead utilize excess capacity during off-peak times to benefit the system as a whole. With so much at stake and with an ever expanding interest in electric vehicles, we expect to see more and more managed charging proposals from utilities in the months and years to come.

* * *

To stay on top of managed charging programs and other EV-related policy activity, check out the 50 States of Electric Vehicles report series or the DSIRE Insight Electric Vehicle Single-Tech Subscription.

The Sale of Narragansett Electric to PPL: Comparing Clean Energy Targets

By: Rebekah de la Mora, Policy Analyst

On February 23, the Rhode Island Division of Public Utilities and Carriers officially approved National Grid's sale of the Narragansett Electric Company to PPL. This would put Narragansett's 780,000+ customers under the care of PPL, adding to their current 2.7 million customers. The attorneys general of both Rhode Island and Massachusetts then submitted motions to their respective supreme courts, asking for a halt to the sale. On March 3, the Supreme Judicial Court of Massachusetts halted the sale, on the grounds that the sale may need a full regulatory proceeding and approval in Massachusetts to review its impact on ratepayers. National Grid and the attorney general later reached a settlement agreement. Now, the case in the Rhode Island Superior Court is under way. The Rhode Island attorney general is arguing that the review of the sale did not take ratepayer impact or compliance with the new climate law into account.

The sale, however, is not the only thing put on hold. Many regulatory proceedings in Rhode Island related to Narragansett's programs have been on hold since the sale was proposed last year. Regulators want clarity on who will be running Narragansett before making decisions on any of the utility's programs. And, as mentioned above, many are concerned that PPL's practices will not fall in line with Rhode Island's new 2021 Act on Climate, which set emissions reduction goals to achieve economy-wide net-zero emissions by 2050.

Saying with 100% certainty whether PPL could meet the Act on Climate is impossible; the future is not so precise as that. A more reasonable question would be is PPL able to meet the Act -- as opposed to will PPL meet the Act. Looking at current expectations and previous actions, one can compare the ability of PPL to align with the state's climate law.

State Clean Energy Targets

First, what are the climate goals that have been set? Rhode Island's 2021 Act on Climate defined new emissions reduction goals, based on 1990 levels: a 10% reduction by 2020, 45% by 2030, 80% by 2040, and 100% by 2050. Pennsylvania has an executive order from 2019, based on 2005 levels: a 26% reduction by 2025, and 80% by 2050. Kentucky's 2011 Climate Action Plan, based on 1990 levels, recommended a 20% reduction by 2030. In addition, Rhode Island and Pennsylvania both have renewable portfolio standards in place. Pennsylvania's standard reached its final target in 2021 with an 18% requirement; Rhode Island's 2021 requirement was 17.5%, but the standard will reach its final target in 2035 at 38.5%. Comparatively, Rhode Island's goals are more stringent than the other two states, which means PPL's current climate actions would have to be revised to meet Narragansett's requirements.

Utility Clean Energy Targets

Along with government-mandated goals, National Grid and PPL have their own in-house emissions reduction targets. National Grid's, based on 1990 levels, are: a 20% reduction by 2020, 80% reduction by 2030, 90% by 2040, and 100% by 2050. PPL's, based on 2010 levels, are: a 70% reduction by 2035, 80% by 2040, and 100% by 2050. While the base years differ, PPL's percentages over time are more stringent than Rhode Island's state targets, and it still has a 100% net-zero target for 2050 like Rhode Island does. PPL's climate actions would, eventually, align with Rhode Island's goals, even if exact percentages reached over time weren't identical.

Emission Reductions to Date

Requirements and expectations, however, are not the same thing as action. So, second, how well are the utilities' achieving these goals? How much have they already reduced their emissions? National Grid reduced its emissions by 70% in 2020 based on 1990 levels, and PPL reduced its emissions by 59% in 2020 based on 2010 levels. While National Grid has demonstrated more progress and more ambitious targets, PPL's advancement is still well in line with both its internal 70% by 2035 target and Rhode Island's 45% by 2030 goal.

Other Issues

Overall, it cannot be said that PPL is wholly incapable of meeting Rhode Island's standards. Although the utility has less aggressive emission reduction targets, they are not low when compared to most utilities across the country. It is perhaps a lower score compared to National Grid, but it is not a low score in and of itself. That being said, meeting climate goals is not the only job of a utility. Other issues have been raised throughout the sale which could affect the performance of Narragansett -- for example, some concerns relate to storm response and resiliency.

As the smallest state in the US, Rhode Island has limited in-state resources when it comes to emergencies, e.g. power outages from snow storms or hurricanes. Under National Grid, Narragansett is able to take advantage of contiguous operations in Massachusetts and New York, sharing resources and labor in an emergency. It would not be able to do that to the same extent under PPL, which operates in Pennsylvania and Kentucky; additionally, weather-based emergencies in Pennsylvania and Kentucky are not the same as weather-based emergencies in Rhode Island, Massachusetts, and New York.

PPL, on the other hand, argues that the distance would be a benefit. The distance between the service territories would mean that Rhode Island would not have emergency events at the same time as the rest of PPL's territory; generation plants in Pennsylvania and Kentucky would not be affected by the emergency, and resources could be fully allocated to Rhode Island without needing to split between the three states. The trade-off, then, would come down to how easily Rhode Island can take advantage of another state's resources: National Grid would require competition with other services territories but shorter wait times, while PPL would require longer wait times as labor and resources are moved across the Northeast but without competition.

How the pieces will fall is yet to be determined. A hearing was held on April 12 for oral arguments in the Rhode Island court case, and no other hearings are scheduled. The court is expected to make a decision with the current information, but when that will be is unknown.

* * *

To learn more about DSIRE Insight’s custom policy research and analysis services, contact us at afproudl@ncsu.edu.

Local Solar Policies and the SolSmart Program

By: David Sarkisian, Sr. Policy Project Manager

The DSIRE Insight team focuses a lot of our work on policies implemented at the state level, either by legislatures or by utility regulatory commissions. Energy policy is not just made by states, though. Obviously, some policies are developed and implemented at the federal level. On the other end of the scale, many important policies are developed by local governments. As media attention and policy discussions focus on federal and state-level policies, local government policies often fly under the radar.

This does not mean that local policies are unimportant. Local governments control key policy areas, most notably the zoning and building permitting processes, that can have a large effect on the scale and type of renewable (and other) energy development in their jurisdictions. In the case of solar energy, local government policies can contribute (positively or negatively) to the oft-discussed “soft costs” that make up the majority of solar deployment costs.

Some of the soft costs associated with local government policies reflect thorny policy concerns, such as preservation of historic neighborhoods and prevention of land-use conflicts. However, in many cases soft costs result more from a lack of clarity in zoning rules or unintended procedural hurdles than from deliberate policy decisions. These clarity and procedural issues often reflect the relative newness of distributed solar and the difficulty of regulating it within frameworks which were not designed with it in mind (similar issues are emerging with distributed energy storage and EV charging equipment, which are even more recent entrants into the popular market).

Since 2016, the SolSmart program has helped local governments reduce these barriers and foster local solar markets. SolSmart is administered by the Interstate Renewable Energy Council (IREC) and the International City/County Management Association (ICMA), and funded by the U.S. Department of Energy Solar Energy Technologies Office. SolSmart is a recognition and technical assistance program that provides designation to local governments that have taken certain steps to reduce solar soft costs in their jurisdictions. Designation comes at three levels: Bronze, Silver, or Gold, with Gold being the highest level. The steps required to obtain SolSmart designation focus on the provision of clear and efficient definitions, rules, and processes rather than specific policy requirements, allowing communities to address other policy concerns while still providing a solar-friendly regulatory framework. Since its inception, the SolSmart program has provided designation to nearly 450 communities in 41 states and D.C. A review of the SolSmart program indicates that designated communities have increased solar installations and faster permitting processes.

To assist local governments in attaining designation, IREC and ICMA work with other organizations to provide technical assistance at no cost. DSIRE Insight team members have partnered with the SolSmart program several times to provide intensive technical assistance to communities in the U.S. Southeast. Any municipality, county, and regional organization in the United States is eligible to apply for SolSmart designation; please contact the SolSmart program for more information.

Data Gathering at Scale: Advanced Metering Infrastructure

By: Vincent Potter, Policy Analyst

Advanced Metering Infrastructure (AMI) is a key facet of grid modernization. AMI goes beyond meters, relays, switches, and other physical components of the grid. Each field device can potentially gather and transmit data about its status and the characteristics of the power that flows through it. Each field device is a potential data point that utilities and customers can leverage to make the best possible decisions. The data gathered can be sensitive; learning the exact load details of a factory can reveal some trade secrets. Likewise, residential load profiles can show occupancy, activity, and sleep schedules that many would not share publicly.

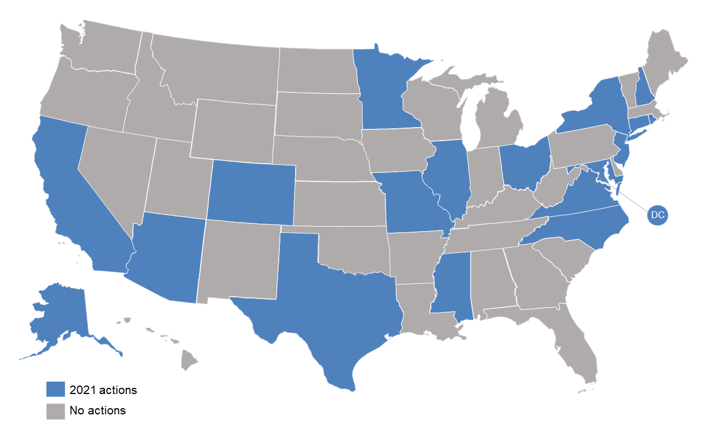

Throughout 2021, 27 separate state or utility actions dealt with electricity data and data access. The 50 States of Grid Modernization 2021 Annual Report contains data about the progress and content of many of the bills and dockets regarding expansions in deployment of advanced infrastructure capable of collecting data and specific plans for utility utilization.

2021 Data Access Policy Actions

Data Acquisition

Advanced metering infrastructure is capable of measuring and transmitting large quantities of data back to a server. Electric meters can measure, in some cases minute-by-minute, changes in load demand and consumption patterns. Taken over long periods, this data makes a load profile that can be analyzed and used for any number of tasks by utility companies and end-users. Through careful analysis, utilities can make extrapolations for future usage trends or closely monitor grid outages in real time. Customers can use this data to find optimal times to run their industrial operations, determine benefits of on-site generation, or to decide on climate control schedules.

Depending on the configuration of the system, advanced metering data can be presented in several ways. Real time information streams in from meters and field devices to servers for immediate or short-term analysis. Utilities can use this data to follow load curves and make tweaks to their dispatched generation. Historical data in 15-minute or 1-hour intervals can show usage trends over time. If real-time data affects day-to-day operations, then interval data is used for longer term planning. Historical interval data, for example, might be used to create a demand response plan to reduce peak load, but real-time data would be needed to deploy it most effectively.

The glut of information from smart meters goes well beyond the historical utility purview of financial information and generation capacity and dispatch. Lawmakers and regulators are increasingly requiring utilities to safeguard customer energy data, and for good reason. By analyzing the load profile of buildings, a viewer can gain much information about what is going on inside. One can determine operational schedules, occupancy hours and trends, when large appliances are run, etc. While the utilities are entrusted with all of this information, they must take measures to aggregate and anonymize data when reporting to third parties. In some states, utilities can only provide customer energy data to third parties with customer consent.

As of February 2022, eight states have bills pending in their legislatures that deal broadly with customer data access. These range from rules about whether utilities can sell their energy data to requiring utilities to articulate their plan for dealing with advanced metering infrastructure data. Most either require customer consent or explicit privacy rules before utilities can disclose non-aggregated data to third parties. Some regulators and lawmakers are also proposing rules that would provide customers with no-cost access to their data, requiring utilities to add to existing or create new web portals.

Pending Data Access Legislation (February 2022)

Customer Data Uses

Customers of all rate classes can use their energy data to make more informed energy consumption decisions. Residential customers can sometimes have less control over their electrical demands than commercial and industrial customers but interval data can still prove useful, especially over time. If a residential customer has the same loads over time, but increasing energy usage, the data can tell them when their consumption is changing to help identify problems with equipment inside their home.

Many large commercial and industrial operations have dedicated energy management strategies and employ devices that can monitor the energy needs of electrical panels or pieces of equipment. Electric data from advanced meters can supplement this pinpoint data to show the “big picture” of energy use at a facility. Commercial and industrial customers often have equipment driven by motors with large startup energy demands, but relatively lower continuous energy needs. Granular energy data can tell these customers what their energy use pattern is so that managers can determine the optimal schedule for equipment use to minimize electric demand (and demand charges).

All customers who pay based on their peak electric demand can benefit from real-time or interval electricity data. Bills and utility records from the analog era can only tell a customer what their peak consumption was and not when it occurred. Smart meter data can show the customer how their energy use changes over time so that they can match their energy peak with their system operations and decide if their peak energy use can be reasonably reduced. Peak reduction strategies include changing operation schedules, retrofitting equipment and facilities, or offsetting peaks directly with on-site generation or energy storage. Deployment of energy storage or generation to reduce peaks depends on accurate real-time energy data for the best results.

Customers can also leverage the data from advanced metering to compare utility rate options. Many electric tariffs do not charge different prices for consumption at different hours of the day, meaning that customers have little economic incentive to change their consumption behaviors. With time-varying rates, sometimes called “Time of Use” or “Time of Day” pricing, utilities charge different prices throughout the day to partially reflect the expense of generating excess energy during periods of high demand. Using granular energy data, customers can compare their energy use with their utility’s rate offerings to either determine the best tariff to match their consumption pattern, or to tell what activities they may need to alter to best deal with a new electric rate.

Utility Data Uses

Utilities have employed demand response programs in varying forms for decades. These programs allow the utilities to isolate and de-energize certain equipment in times of high energy demand. Typical targets for demand response programs include air conditioners and large equipment on intermittent schedules.

An outage management system (OMS) collects reports of power outages and can predict failed equipment and fault location related to system reports of outages. Customer-facing data for system outages come from these systems, they also record outages and less serious system faults for regulatory reporting. OMS manage unexpected fault data including detection, location, repair and isolation. An OMS is a coordinator for tasks, planning outages, recordkeeping, and processes associated with distribution system outages. OMS can be a communication system for utility stakeholders, internal and external, and provide the backbone of outage notifications for app or web interfaces.

Advanced OMS can use precise location data to display faults and system issues in real time. OMS can reduce the need for searching for faulty parts of a distribution system and thereby lessen the time for personnel to start repairs to restore operations. Combined with remotely operated switches, faulty sections of the network can be isolated or bypassed to maintain service to as many customers as possible. The utility can use the OMS to make predictions for system behavior during faults and use that data to inform their planning efforts.

Utilities have to factor in a lot of information to plan for system upgrades and additions. Using granular data as part of energy modeling, utilities can form a more complete picture of their customer demands and plan accordingly. Generation and transmission capacity can be compared to usage trends and data from their customers, which can provide more relevant information than generalizations or industry standard data. In the context of transmission build-out, the utilities can use real data from their service area to see where their feeders and infrastructure may soon be insufficient and allocate funds accordingly.

Overall

Both utilities and customers make decisions with the best data available at that moment. Advanced metering infrastructure can provide utilities with more precise and more reliable data for planning and system operations. Customers can take advantage of this data as well to make the best decisions on how and when to consume electricity, choose the best rate option to fit their needs, and identify potential equipment problems that may not be immediately obvious. Because energy data can reveal so much about operations, schedules, and even personal habits, there are many regulations on how this data is stored and presented. Lawmakers and regulators are directing utilities to become custodians of customer data; many utilities are required to protect customers’ data and make it available to customers and their designees through secure means.

* * *

Keep up with legislative and regulatory changes related to data access with the 50 States of Grid Modernization report or DSIRE Insight’s Single-Tech Grid Modernization Subscription.

The Quick and Dirty on Agrivoltaics

By: Ethan Beaulieu, Energy Policy Research Assistant

Agrivoltaics can be broadly understood as the co-opting of agricultural land and practices, with solar photovoltaics (PV). Agrivoltaics can appear in a variety of structural types, each intended to create conditions in which dual use of land with solar PV arrays is viable. Agrivoltaics demonstrates that the relationship between agriculture and solar PV around land use, need not be exclusively competitive. In many cases, agrivoltaics is mutually beneficial for both those wishing to protect or restore traditionally agricultural land, and those satisfying the demand for solar PV systems.

What Solar Agrivoltaics Look Like

Solar agrivoltaics is not exclusive to large-scale utility solar PV systems. Due to the flexibility in which arrays can be installed, solar agrivoltaics is attainable for both commercial use and large-scale utility projects.

The structure type that is first brought to mind for many people is raised structures. This technique includes the installation of solar PV arrays on stilts a number of feet above the ground. Crops are then cultivated underneath the panels. The solar PV arrays have the potential to have sun tracking systems for increased efficiency, though for temporary systems, the investment may not be worth it. This structure type appears to be the most popular and occupies the majority of research on agrivoltaics. However, the raised structures are not without drawbacks. Increased initial investment is required compared to traditional solar PV arrays, due to additional material and labor. The structures are by nature larger than traditional solar PV due to their elevation which, in turn, needs to be reinforced against wind.

The second structure type, spaced, is similar to traditional ground-mounted PV systems. In this arrangement, solar arrays are mounted low to the ground and set in alternating rows with crops. These systems have significantly decreased density of solar arrays compared to other systems. However, they allow for the possibility of mechanized agriculture where the machines are able to hurdle the arrays. Such systems also are a lower initial investment compared to raised structures.

How Agrivoltaics Affect Soil Quality and Conditions

It should first be noted that there is a great deal of variety in soil types, topography, and climate conditions throughout the United States. Therefore, some issues or benefits may be more or less exaggerated depending on the environmental factors.

The first issue that arises with agricultural land that intends to be used for normal operation in the future is soil compaction during construction and decommissioning. During both of these phases, heavy machinery and equipment will be needed to install or remove arrays on the land. The weight of the machines has the possibility of compacting soil, which can reduce the productivity of the field. To minimize compaction and maintain soil quality, the following practices are followed:

Reducing the number of roads on the site and placing them on less productive land

Avoiding the use of gravel

Not removing the layer of topsoil during construction

Leaving as much vegetation as possible during installation to avoid erosion

Using pallets, wooden planks, or other means to distribute weight of machinery on roads

Drilling in or ramming steel posts rather than using large machinery during installation

It should be mentioned that while it is possible to mitigate soil compaction, certain activities have a greater likelihood of compaction. For raised systems, the installation of the structure requires that steel beams be placed at a substantial depth within the ground. The taller the structure, the farther down it must go. The associated labor and weight of material contributes to the level of compaction. In cases of severe soil compaction, tools like tractor mounted chisels, or vibrators that can break up affected soil.

Compared to raised structures, spaced ones see a lesser degree of compaction. One of the benefits of having a spaced agrivoltaic layout is that in high wind conditions, the solar arrays act as a buffer to deter erosion.

What Types of Plants Are Best Suited to Agrivoltaics?

The biggest determining factor in crop choice is shade tolerance. Sufficient light must be passing through to the ground for the crop to flourish. In the case of raised structures, this is affected by the height of the structure. Crops that require large amounts of light and suffer significantly from its reduction are not good for agrivoltaics. This would include barley, corn, wheat, and fruits. However, many leaf vegetables and berries benefit from less solar radiation. These include spinach, hops, onions, cucumber, zucchini, and a variety of other crops. As a general rule, crops that are grown in rows and do not require mechanized agriculture have been seen to perform the best economically, since the panel height is less likely to interfere with farming activities.

A number of studies found that compared to control groups, agrivoltaic systems helped the soil retain moisture, improved the production of some crops, and reduced ground temperature during the day and made it warmer at night. For many, there may be a concern that heat from the solar panels will negatively affect the crops beneath or around them. Traditional solar PV arrays with gravel ground cover may have a heat feedback loop or “heat island” effect, which exists near the array. However, the heat feedback loop created by the gravel and panel’s greater ability to absorb temperature than normal land, can be countered by using ground cover vegetation and strategic planting. Studies found that the temperature of solar panels in agrivoltaic systems were lower than that of traditional PV systems using gravel ground cover. Lower panel temperature also allows the panels to perform better.

The Bigger Picture

There are still many roadblocks to the widespread use of agrivoltaic systems, namely issues with zoning and land use. Since authority over land use is delegated to state governments and then to municipalities, there is a great deal of inconsistency in zoning law regarding agrivoltaics. While such systems still perform their agricultural function, they are subject to the same permitting and regulatory process that a conventional solar PV installation would be. Only the state of Massachusetts has a policy program intended to promote and incentivize agrivoltaic development.

Agrivoltaics may not be the ideal solution for all utility-scale PV systems, but for farmers looking to capitalize on unused crop land, those who would like to revitalize topsoil while still obtaining revenue, or would simply like to preserve traditionally agricultural land, agrivoltaics presents a valuable opportunity. More broadly, it represents the combination of what are often conflicting interests, and how co-operation can be mutually beneficial.

Legislative Activity on Community Solar in the Midwest

By: David Sarkisian, Senior Project Manager

Community solar is a program model allowing people, businesses, and organizations to purchase shares or subscriptions to the output of larger-scale solar projects. It provides an avenue for access to solar energy for people who cannot, or prefer not to, install rooftop solar panels. Community solar programs can be offered by electric utilities, and in many states community solar programs allow participation by third-party providers.

In the Midwest, community solar has historically had a foothold in Minnesota, which currently has the largest amount of third-party community solar capacity of any state. More recently, Illinois has seen considerable community solar activity in connection with its 2016 Future Energy Jobs Act, which established two REC-based incentive programs for community solar (and other solar) development. Illinois’ 2021 clean energy legislation, the Climate and Equitable Jobs Act, continues and expands the state’s support for community solar.